Rising Healthcare Costs

The dental insurance market in Spain is significantly influenced by the rising costs associated with healthcare services. As dental procedures become more expensive, consumers are increasingly seeking insurance solutions to alleviate the financial burden of necessary treatments. Data suggests that dental care costs have risen by approximately 15% over the last five years, prompting individuals to consider insurance options that can help manage these expenses. This trend indicates a growing recognition of the importance of dental insurance as a financial safeguard against unexpected dental costs. Consequently, insurers are likely to respond by developing more comprehensive plans that cater to the needs of cost-conscious consumers.

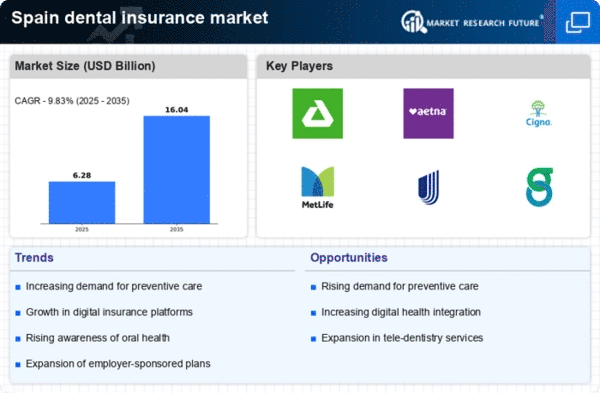

Increasing Awareness of Oral Health

The dental insurance market in Spain is experiencing a notable shift as public awareness of oral health continues to rise. Educational campaigns and initiatives by health organizations have emphasized the importance of regular dental check-ups and preventive care. This heightened awareness is likely to drive demand for dental insurance products, as individuals seek to mitigate potential costs associated with dental treatments. According to recent data, approximately 60% of the Spanish population now recognizes the value of dental insurance, reflecting a significant increase from previous years. As consumers become more informed about the benefits of maintaining oral health, the dental insurance market is poised for growth, with insurers adapting their offerings to meet the evolving needs of the population.

Expansion of Employer-Sponsored Plans

the dental insurance market in Spain is seeing an expansion of employer-sponsored dental plans.. Many companies are increasingly recognizing the value of offering comprehensive dental coverage as part of their employee benefits packages. This trend is driven by the desire to enhance employee satisfaction and retention. Recent statistics indicate that around 40% of Spanish employers now provide dental insurance as part of their benefits, a figure that has steadily increased over the past few years. As more organizations adopt this approach, the dental insurance market is likely to see a surge in enrollment, leading to greater competition among insurers to provide attractive and affordable plans.

Demographic Changes and Aging Population

the dental insurance market in Spain is shifting due to demographic changes, particularly the aging population.. As the proportion of older adults increases, there is a corresponding rise in the demand for dental services tailored to this demographic. Older individuals often require more extensive dental care, which can be costly without insurance coverage. Recent projections indicate that by 2030, nearly 25% of the Spanish population will be over 65 years old, highlighting the need for insurance products that cater to their specific dental health needs. This demographic trend is likely to drive growth in the dental insurance market, as insurers develop specialized plans to accommodate the unique requirements of an aging clientele.

Technological Advancements in Dental Care

the dental insurance market in Spain is shaped by rapid technological advancements in dental care.. Innovations such as tele-dentistry, digital imaging, and AI-driven diagnostics are transforming the way dental services are delivered. These advancements not only enhance patient experience but also improve treatment outcomes, making dental care more efficient and accessible. As technology continues to evolve, consumers may increasingly seek insurance plans that cover these modern services. The integration of technology into dental practices is likely to drive demand for insurance products that align with these advancements, thereby influencing the overall landscape of the dental insurance market.