Rising Cybersecurity Concerns

As the reliance on digital communication grows, so do concerns regarding cybersecurity, which is a critical driver for the communications interface market. In Spain, businesses are increasingly aware of the potential risks associated with data breaches and cyberattacks. This awareness has led to a heightened demand for secure communication interfaces that incorporate advanced encryption and authentication measures. Recent studies indicate that 70% of Spanish companies prioritize cybersecurity in their technology investments. This trend suggests that the communications interface market needs to adapt to these security challenges, potentially leading to innovations in secure communication protocols and user authentication methods.

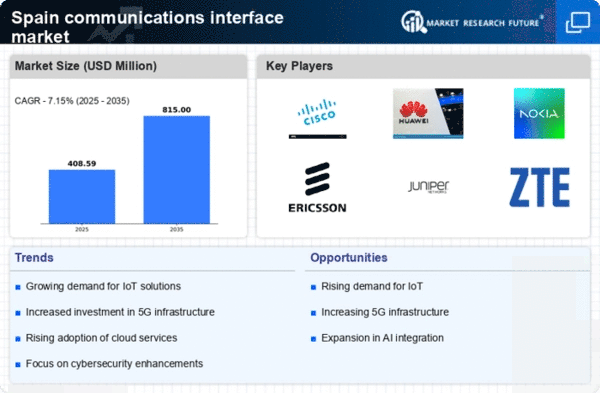

Expansion of 5G Infrastructure

The ongoing expansion of 5G infrastructure in Spain is a pivotal driver for the communications interface market. With the deployment of 5G networks, the demand for advanced communication interfaces is expected to surge. This technology enables faster data transmission and lower latency, which are crucial for applications such as smart cities and autonomous vehicles. As of 2025, the Spanish government has allocated approximately €1 billion to enhance telecommunications infrastructure, which is likely to stimulate growth in the communications interface market. The integration of 5G technology is anticipated to create new opportunities for businesses, enhancing connectivity and enabling innovative solutions that rely on robust communication interfaces.

Adoption of Artificial Intelligence Technologies

The integration of artificial intelligence (AI) technologies into communication systems is emerging as a transformative driver for the communications interface market in Spain. AI can enhance user experience by enabling intelligent features such as natural language processing and predictive analytics. As businesses seek to improve customer engagement and streamline operations, the demand for AI-driven communication interfaces is likely to increase. Market analysis indicates that the AI communications sector in Spain could grow by 30% by 2026. This growth reflects the potential for AI to revolutionize how communication interfaces function, making them more intuitive and responsive to user needs.

Government Initiatives for Digital Transformation

The Spanish government has launched various initiatives aimed at promoting digital transformation across industries, which serves as a significant driver for the communications interface market. Programs such as the Digital Spain 2025 agenda focus on enhancing digital infrastructure and fostering innovation. By investing in technology and communication systems, the government aims to improve connectivity and accessibility for businesses and citizens alike. This initiative is expected to result in a market growth rate of approximately 20% over the next few years. As organizations align with these government objectives, the demand for sophisticated communication interfaces is likely to increase, driving further advancements in the market.

Increased Demand for Remote Communication Solutions

The rise in remote work and virtual collaboration tools has significantly influenced the communications interface market in Spain. As organizations adapt to new working models, there is a growing need for reliable and efficient communication interfaces that facilitate seamless interaction among remote teams. According to recent data, the market for remote communication solutions in Spain is projected to grow by 25% annually through 2025. This trend indicates a strong demand for advanced interfaces that support video conferencing, instant messaging, and collaborative platforms. Consequently, companies are investing in developing user-friendly and secure communication interfaces to meet the evolving needs of the workforce.