Increasing Space Debris

The proliferation of space debris poses a substantial challenge to the Global Space Situational Awareness Market Industry. As of 2024, it is estimated that there are over 36,500 pieces of debris larger than 10 cm orbiting Earth. This increasing volume of debris necessitates advanced tracking and monitoring systems to prevent collisions with operational satellites and spacecraft. The potential for catastrophic events due to debris impacts drives investment in space situational awareness technologies, as stakeholders recognize the need for enhanced safety measures. Consequently, this trend is likely to bolster market growth, contributing to the projected market value of 1.1 USD Billion in 2024.

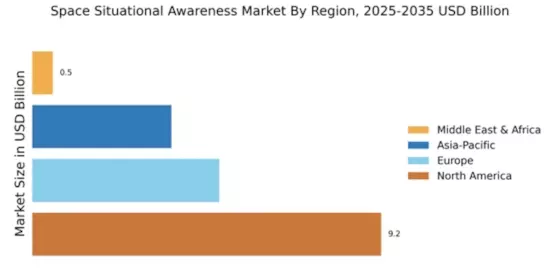

Market Growth Projections

The Global Space Situational Awareness Market Industry is poised for substantial growth, with projections indicating a market value of 1.1 USD Billion in 2024 and an anticipated increase to 2.46 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 7.6% from 2025 to 2035. The increasing demand for effective monitoring solutions, driven by factors such as space debris, commercial activities, and government initiatives, underscores the market's potential. As stakeholders recognize the importance of situational awareness in ensuring safe and sustainable space operations, investments in this sector are expected to rise significantly.

Technological Advancements

Rapid advancements in satellite technology and data analytics are transforming the Global Space Situational Awareness Market Industry. Innovations in sensor technology, artificial intelligence, and machine learning facilitate real-time tracking and analysis of space objects. These developments enable more accurate predictions of potential collisions and enhance decision-making processes for space operators. The integration of advanced technologies is likely to attract investments and drive market expansion. As the industry evolves, the demand for sophisticated solutions is expected to grow, contributing to a compound annual growth rate of 7.6% from 2025 to 2035.

Commercial Space Activities

The surge in commercial space activities, including satellite launches and space tourism, significantly impacts the Global Space Situational Awareness Market Industry. As more private companies enter the space sector, the need for effective monitoring and management of space traffic becomes increasingly critical. This trend is evidenced by the growing number of satellites being deployed, which is projected to reach over 100,000 by 2030. The expansion of commercial ventures necessitates robust situational awareness capabilities to ensure safe operations in crowded orbits. Consequently, this dynamic environment is likely to drive market growth and innovation.

International Collaboration

International collaboration is becoming a cornerstone of the Global Space Situational Awareness Market Industry. Various nations are recognizing the importance of sharing data and resources to enhance global monitoring capabilities. Initiatives such as the Space Data Association facilitate information exchange among satellite operators, improving overall situational awareness. This collaborative approach not only enhances safety but also fosters innovation in tracking technologies. As countries work together to address common challenges in space, the market is poised for growth, driven by shared investments and collective advancements in space situational awareness.

Government Initiatives and Policies

Governments worldwide are increasingly prioritizing space situational awareness, recognizing its critical role in national security and economic stability. Initiatives such as the United States Space Policy Directive-3 emphasize the importance of space traffic management and debris mitigation. These policies foster collaboration among nations and private entities, thereby enhancing the Global Space Situational Awareness Market Industry. As countries invest in advanced technologies and infrastructure to monitor space activities, the market is expected to benefit significantly. This trend aligns with the anticipated growth trajectory, with projections indicating a market value of 2.46 USD Billion by 2035.