Rising Energy Costs

The increasing costs of traditional energy sources in South Korea are driving the photovoltaic market. As fossil fuel prices fluctuate, consumers and businesses are seeking more stable and predictable energy costs. The photovoltaic market offers a viable alternative, allowing users to generate their own electricity and reduce reliance on external suppliers. In 2025, the average electricity price in South Korea is projected to rise by approximately 10%, further incentivizing the adoption of solar energy solutions. This trend suggests that as energy prices continue to escalate, the photovoltaic market will likely experience heightened demand, as both residential and commercial sectors look to mitigate their energy expenses.

Environmental Awareness

Growing environmental consciousness among South Korean citizens is significantly impacting the photovoltaic market. As climate change concerns escalate, there is a notable shift towards sustainable energy solutions. The South Korean government has set ambitious targets to reduce greenhouse gas emissions by 40% by 2030, which aligns with the increasing adoption of solar technologies. Public campaigns and educational initiatives are fostering a culture of sustainability, leading to a surge in interest in renewable energy sources. This heightened awareness is likely to propel the photovoltaic market forward, as consumers actively seek eco-friendly alternatives to traditional energy sources.

Technological Innovation

Technological advancements in solar panel efficiency and energy storage are transforming the photovoltaic market in South Korea. Innovations such as bifacial solar panels and improved battery technologies are enhancing the performance and reliability of solar energy systems. In 2025, the efficiency of solar panels is expected to reach an average of 22%, making them more attractive to consumers. These advancements not only reduce the cost of solar energy generation but also increase the overall appeal of photovoltaic systems. As technology continues to evolve, the photovoltaic market is likely to benefit from increased adoption rates and a broader range of applications.

Government Support Programs

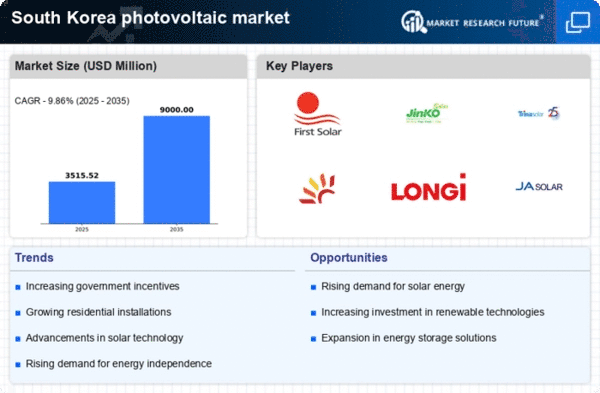

The South Korean government is actively promoting the photovoltaic market through various support programs and initiatives. Financial incentives, such as subsidies and tax credits, are designed to encourage both residential and commercial investments in solar energy. In 2025, the government aims to install 30 GW of solar capacity, reflecting a commitment to renewable energy. These programs are likely to lower the initial investment barriers for consumers, making solar energy more accessible. As government support continues to grow, the photovoltaic market is expected to expand, attracting new players and fostering innovation within the sector.

Urbanization and Infrastructure Development

Rapid urbanization in South Korea is creating new opportunities for the photovoltaic market. As cities expand, there is an increasing demand for sustainable energy solutions to power urban infrastructure. The integration of solar panels into buildings and public spaces is becoming more prevalent, driven by both aesthetic and functional considerations. In 2025, it is anticipated that urban areas will account for over 60% of total energy consumption, highlighting the need for efficient energy solutions. This trend suggests that the photovoltaic market will likely thrive as urban planners and developers prioritize renewable energy integration in their projects.