Regulatory Pressures

In South Korea, regulatory pressures are driving the mobile security market as organizations strive to comply with stringent data protection laws. The Personal Information Protection Act (PIPA) mandates strict guidelines for handling personal data, compelling businesses to enhance their mobile security measures. Non-compliance can result in hefty fines, which may reach up to 3% of a company's annual revenue. This regulatory landscape is prompting companies to invest in mobile security solutions that ensure data integrity and confidentiality. As organizations navigate these legal requirements, the mobile security market is likely to see a surge in demand for compliance-focused security technologies. The emphasis on regulatory adherence is expected to contribute to a market growth rate of approximately 12% annually, as firms seek to mitigate risks associated with data breaches.

Increasing Cyber Threats

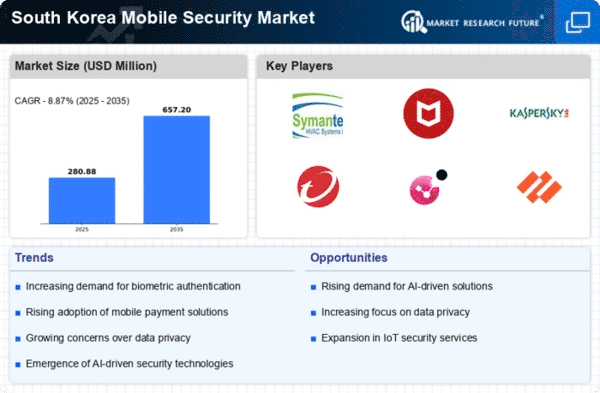

The mobile security market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats in South Korea. With a reported 30% rise in mobile malware attacks over the past year, organizations are compelled to invest in robust security solutions. The proliferation of mobile devices has created a larger attack surface, making it essential for businesses to adopt advanced security measures. This trend is further fueled by the growing reliance on mobile applications for financial transactions and sensitive data management. As a result, the mobile security market is expected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of 15% over the next five years.. Companies are prioritizing the implementation of comprehensive security frameworks to safeguard their mobile environments against evolving threats.

Rising Mobile Payment Adoption

The rapid adoption of mobile payment systems in South Korea is significantly influencing the mobile security market. With over 70% of the population utilizing mobile payment platforms, the need for secure transactions has never been more critical. This trend is prompting financial institutions and service providers to invest heavily in mobile security solutions to protect sensitive financial information. As cybercriminals increasingly target mobile payment systems, businesses are prioritizing the implementation of advanced encryption and authentication technologies. The mobile security market is projected to benefit from this trend, with an anticipated growth rate of 14% over the next few years. The integration of security features into mobile payment applications is becoming a key differentiator for service providers, further driving market expansion.

Consumer Awareness and Education

Consumer awareness regarding mobile security threats is on the rise in South Korea, significantly impacting the mobile security market. As individuals become more informed about the risks associated with mobile device usage, there is a growing demand for security solutions that protect personal data. Educational campaigns and initiatives by government agencies and private organizations are fostering a culture of security consciousness among users. This heightened awareness is likely to lead to increased adoption of mobile security applications and services, as consumers seek to safeguard their devices against potential threats. The mobile security market is expected to see a corresponding growth, with estimates indicating a 10% increase in consumer spending on security solutions in the coming years. This trend underscores the importance of user education in driving market dynamics.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the mobile security market in South Korea. Innovations such as biometric authentication, machine learning, and blockchain technology are enhancing the effectiveness of security solutions. These advancements enable organizations to implement more sophisticated security measures that can adapt to evolving threats. As businesses seek to leverage these technologies, the mobile security market is likely to experience accelerated growth. The integration of AI-driven security solutions is particularly noteworthy, as it allows for real-time threat detection and response. Market analysts project a growth rate of 13% for the mobile security market, driven by the increasing adoption of cutting-edge technologies. This trend highlights the importance of continuous innovation in maintaining robust mobile security frameworks.