Supportive Government Policies

Supportive government policies aimed at promoting herbal medicine are likely to bolster the medicinal plant-extracts market. In South Korea, the government has been actively encouraging the use of traditional herbal products through various initiatives, including funding for research and development. This regulatory support is expected to enhance consumer confidence in herbal products, thereby driving market growth. The medicinal plant-extracts market may see an increase in product approvals and certifications, which could further stimulate demand. As the government continues to advocate for the integration of traditional medicine into the healthcare system, the market is poised for substantial growth.

Rising Popularity of Herbal Remedies

The rising popularity of herbal remedies is significantly influencing the medicinal plant-extracts market. In South Korea, there is a cultural inclination towards using herbal solutions for various ailments, which is being reinforced by modern research validating traditional practices. The market is expected to reach a valuation of around $500 million by 2026, driven by the growing acceptance of herbal products among younger demographics. This demographic shift suggests that the medicinal plant-extracts market may experience a robust expansion as more consumers turn to herbal alternatives for health management. The integration of herbal remedies into daily health routines is likely to further solidify this trend.

Advancements in Extraction Technologies

Advancements in extraction technologies are playing a crucial role in enhancing the quality and efficacy of plant extracts, thereby benefiting the medicinal plant-extracts market. Innovative methods such as supercritical fluid extraction and ultrasonic extraction are being adopted to improve yield and purity. These technologies not only optimize the extraction process but also ensure that the bioactive compounds are preserved effectively. As a result, the medicinal plant-extracts market is witnessing an influx of high-quality products that meet consumer demands for potency and safety. This technological evolution may lead to increased market competitiveness and the introduction of novel products that cater to specific health needs.

Growing Consumer Awareness of Health Benefits

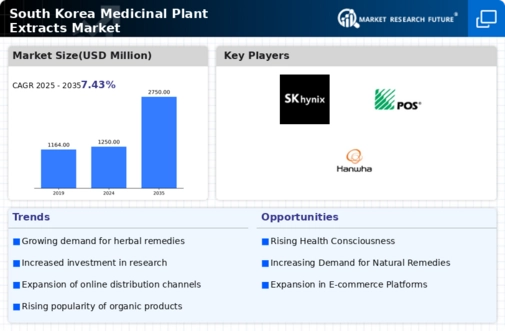

The increasing consumer awareness regarding the health benefits of natural remedies appears to be a pivotal driver for the medicinal plant-extracts market. As individuals become more health-conscious, they tend to seek alternatives to synthetic pharmaceuticals. This trend is particularly pronounced in South Korea, where traditional medicine has a long-standing history. The market for herbal supplements and extracts is projected to grow at a CAGR of approximately 8% over the next five years. This growth indicates a shift towards preventive healthcare, with consumers actively seeking products that promote wellness and longevity. The medicinal plant-extracts market is thus likely to benefit from this heightened awareness, as consumers increasingly prioritize natural ingredients in their health regimens.

Increasing Applications in Cosmetics and Personal Care

The increasing applications of medicinal plant extracts in the cosmetics and personal care sector are emerging as a significant driver for the medicinal plant-extracts market. South Korean consumers are increasingly drawn to products that incorporate natural ingredients, particularly in skincare and beauty formulations. The market for herbal-infused cosmetics is projected to grow by approximately 10% annually, reflecting a shift towards clean beauty trends. This trend suggests that the medicinal plant-extracts market could expand its reach beyond traditional health applications, tapping into the lucrative beauty market. As consumers seek products that align with their values of sustainability and health, the demand for plant-based extracts in cosmetics is likely to rise.