Rising Infertility Rates

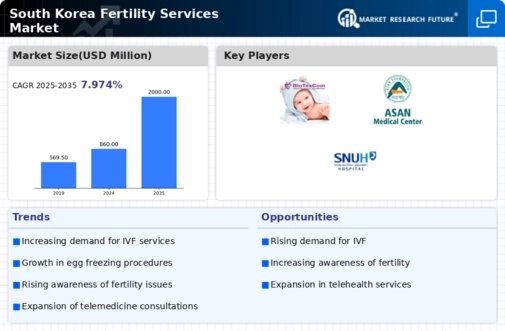

The fertility services market in South Korea is experiencing growth due to increasing infertility rates among couples. Recent data indicates that approximately 15% of couples in South Korea face infertility issues, which has led to a heightened demand for assisted reproductive technologies. This trend is further exacerbated by lifestyle factors such as delayed marriage and childbearing, as well as environmental influences. As a result, The fertility services market is expanding to accommodate the needs of these couples. A variety of treatment options are becoming more accessible.. The rising infertility rates are likely to drive innovation and investment in the fertility services market, as providers seek to offer more effective solutions to meet the growing demand.

Increased Awareness and Education

There is a notable increase in awareness and education regarding fertility issues in South Korea, which is positively impacting the fertility services market. Educational campaigns and resources are becoming more prevalent, helping individuals understand their reproductive health and the options available to them. This heightened awareness is leading to more couples seeking fertility treatments earlier, rather than waiting until issues become more pronounced. As a result, The fertility services market will likely experience a surge in demand for consultations and treatments.. Furthermore, the integration of educational programs in healthcare settings is fostering a culture of proactive reproductive health management, which may contribute to the overall growth of the fertility services market.

Government Regulations and Support

The regulatory environment in South Korea is evolving, with the government implementing policies that support the fertility services market. Recent initiatives include financial assistance programs for couples undergoing fertility treatments, which aim to alleviate the financial burden associated with these services. Additionally, regulations that promote ethical practices in assisted reproductive technologies are being reinforced. These government actions are likely to enhance public trust in fertility services, encouraging more couples to seek help. As the government continues to prioritize reproductive health, the fertility services market may experience sustained growth, driven by increased accessibility and affordability of treatments.

Technological Innovations in Treatment

Technological advancements are playing a crucial role in shaping the fertility services market in South Korea. Innovations such as in vitro fertilization (IVF) techniques, preimplantation genetic testing, and cryopreservation are enhancing the success rates of fertility treatments. The introduction of artificial intelligence in treatment planning and patient management is also streamlining processes and improving outcomes. As these technologies become more sophisticated and accessible, they are likely to attract more patients seeking effective solutions for infertility. The fertility services market is expected to benefit from ongoing research and development. This may lead to the introduction of new treatment modalities and improved patient experiences..

Cultural Shifts Towards Family Planning

Cultural shifts in South Korea are influencing the fertility services market, as societal norms around family planning evolve. There is a growing acceptance of assisted reproductive technologies, which were once stigmatized. This change in perception is encouraging couples to explore fertility treatments without fear of judgment. Moreover, as more women pursue careers and education, the timing of family planning is shifting, leading to a greater reliance on fertility services. The fertility services market is likely to expand as these cultural shifts continue. Providers will adapt their offerings to meet the needs of a diverse clientele seeking to balance personal and professional aspirations..