Public Awareness Campaigns and Education

Public awareness and education initiatives are essential for the growth of the electric mobility market. In South Korea, various campaigns are being launched to inform consumers about the benefits of electric vehicles, including lower operating costs and environmental advantages. These efforts aim to dispel common misconceptions about electric mobility, such as concerns regarding battery life and charging infrastructure. By increasing consumer knowledge and understanding, these campaigns are likely to foster a more favorable perception of electric vehicles. As awareness grows, it is anticipated that more individuals will consider transitioning to electric mobility, thereby driving market demand. The electric mobility market may experience a positive shift as public perception evolves, supported by ongoing educational efforts.

Technological Innovations in Electric Vehicles

Technological advancements are a driving force behind the electric mobility market. In South Korea, innovations in battery technology, such as solid-state batteries, are being actively researched and developed. These advancements promise to enhance energy density, reduce charging times, and extend the lifespan of batteries, which are critical factors for consumer acceptance. Furthermore, improvements in electric drivetrains and vehicle design are likely to enhance performance and efficiency, making electric vehicles more competitive with traditional combustion engines. As these technologies mature, they are expected to attract a broader consumer base, thereby propelling the electric mobility market forward. The continuous evolution of technology may also lead to new business models, such as battery leasing, which could further stimulate market growth.

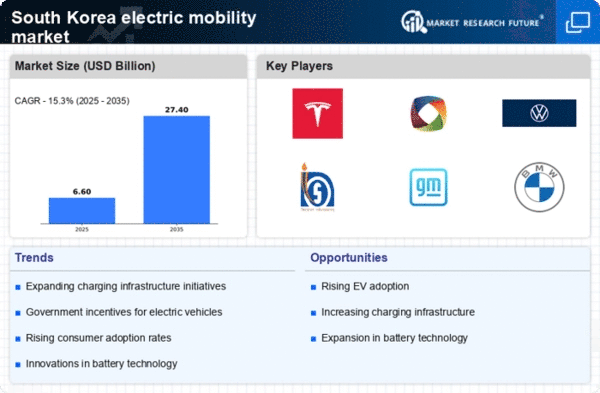

Infrastructure Development for Charging Stations

The expansion of charging infrastructure is a pivotal driver for the electric mobility market. In South Korea, the government has committed to increasing the number of public charging stations, aiming for over 30,000 by 2025. This initiative is expected to alleviate range anxiety among consumers, thereby enhancing the adoption of electric vehicles (EVs). The presence of a robust charging network not only supports current EV users but also attracts potential buyers who may have previously hesitated due to inadequate charging options. Furthermore, the integration of fast-charging technology is likely to improve the overall user experience, making electric mobility more appealing. As the infrastructure develops, it is anticipated that the electric mobility market will witness accelerated growth, driven by increased consumer confidence and convenience.

Economic Incentives for Electric Vehicle Adoption

Economic incentives play a crucial role in promoting the electric mobility market. In South Korea, the government offers substantial subsidies for electric vehicle purchases, which can amount to as much as $10,000 per vehicle, depending on the model. These financial incentives significantly lower the initial cost barrier for consumers, making electric vehicles more accessible. Additionally, tax benefits and exemptions from tolls and parking fees further enhance the attractiveness of EVs. As the economic landscape evolves, these incentives are likely to remain a key driver, encouraging more consumers to transition from traditional vehicles to electric alternatives. Consequently, the electric mobility market may see a notable increase in sales and market penetration as these economic measures continue to support consumer adoption.

Environmental Regulations and Sustainability Goals

Stringent environmental regulations are increasingly shaping the electric mobility market in South Korea. The government has set ambitious targets to reduce greenhouse gas emissions by 40% by 2030, which necessitates a shift towards cleaner transportation solutions. This regulatory framework encourages manufacturers to invest in electric mobility technologies, thereby fostering innovation and competition within the industry. Additionally, the South Korean public is becoming more environmentally conscious, which further propels demand for electric vehicles. The electric mobility market is likely to benefit from these sustainability goals, as both consumers and businesses align their practices with eco-friendly initiatives. As a result, the market may experience a surge in EV adoption, driven by both regulatory compliance and consumer preference for sustainable options.