Aging Population

The demographic shift towards an aging population in South Korea is likely to have a substantial impact on the cough syrup market. Older adults are more susceptible to respiratory issues, which increases their reliance on cough syrups for relief. As the population aged 65 and above is expected to reach 20% by 2025, the demand for cough syrups is anticipated to rise correspondingly. This demographic trend suggests that pharmaceutical companies may need to focus on developing formulations that cater specifically to the needs of older consumers, thereby shaping the future landscape of the cough syrup market.

Increasing Health Awareness

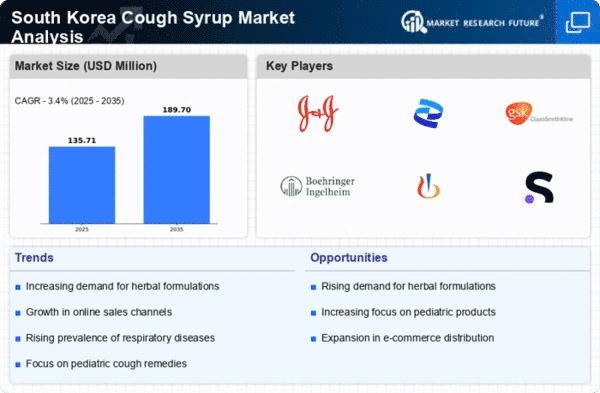

The rising health consciousness among consumers in South Korea appears to be a pivotal driver for the cough syrup market. As individuals become more informed about health issues, they are increasingly seeking effective remedies for common ailments such as coughs. This trend is reflected in the growing demand for cough syrups that are perceived as safe and effective. According to recent data, the market for cough syrups is projected to grow at a CAGR of approximately 5.2% over the next few years. This growth is likely fueled by consumers' preference for products that align with their health values, thereby influencing manufacturers to innovate and enhance their offerings in the cough syrup market.

Innovative Product Development

Innovation in product formulations is emerging as a crucial driver in the cough syrup market. Manufacturers are increasingly focusing on developing syrups that incorporate advanced ingredients, such as herbal extracts and natural compounds, to enhance efficacy and appeal to health-conscious consumers. This trend is indicative of a broader shift towards more sophisticated and targeted cough relief solutions. As companies invest in research and development, the introduction of new products is likely to stimulate growth in the cough syrup market, catering to diverse consumer preferences and needs.

Expansion of Distribution Channels

The expansion of distribution channels is playing a vital role in shaping the cough syrup market. With the rise of both traditional retail and online platforms, consumers in South Korea have greater access to a variety of cough syrup products. This increased availability is likely to drive sales, as consumers can easily compare options and make informed choices. Furthermore, the integration of e-commerce into the distribution strategy allows for a broader reach, potentially increasing market penetration. As a result, the cough syrup market may witness enhanced growth opportunities through improved accessibility and convenience for consumers.

Rising Incidence of Respiratory Diseases

The increasing prevalence of respiratory diseases in South Korea is a significant driver for the cough syrup market. Factors such as urban pollution and lifestyle changes contribute to a higher incidence of conditions like asthma and bronchitis. Recent statistics indicate that respiratory diseases account for a considerable portion of healthcare expenditures, prompting consumers to seek effective cough relief solutions. This trend suggests that the cough syrup market may experience heightened demand as individuals look for products that provide symptomatic relief from these ailments, thereby influencing market dynamics.