Surge in Consumer Electronics Demand

The proliferation of consumer electronics in South Korea is a key driver of the batteries market. With the increasing adoption of smartphones, laptops, and wearable devices, the demand for high-performance batteries is on the rise. In 2025, the consumer electronics sector is anticipated to grow by 15%, further fueling the need for innovative battery solutions. Manufacturers are focusing on developing batteries that offer longer life cycles and faster charging capabilities to meet consumer expectations. This trend not only enhances user experience but also propels the batteries market forward, as companies strive to deliver cutting-edge technology in a competitive landscape.

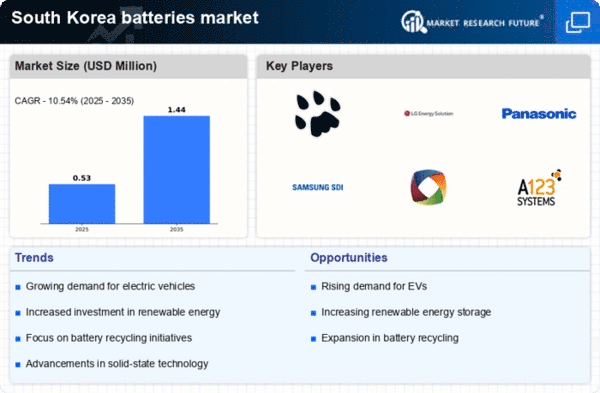

Rising Demand for Renewable Energy Storage

The increasing focus on renewable energy sources in South Korea is driving the batteries market. As the country aims to reduce its carbon footprint, the need for efficient energy storage solutions becomes paramount. Batteries play a crucial role in storing energy generated from solar and wind sources, which are inherently intermittent. In 2025, the renewable energy sector is projected to account for approximately 30% of the total energy mix, necessitating advanced battery technologies. This shift not only supports energy independence but also aligns with government policies promoting sustainable practices. Consequently, the batteries market is likely to experience robust growth as manufacturers innovate to meet the storage demands of renewable energy systems.

Expansion of Electric Public Transportation

The South Korean government is actively promoting the expansion of electric public transportation systems, which is significantly impacting the batteries market. Initiatives to replace traditional buses and taxis with electric alternatives are underway, aiming to reduce urban pollution and enhance public health. By 2025, it is projected that electric buses will constitute over 20% of the total bus fleet in major cities. This transition necessitates the development of robust battery systems capable of supporting longer operational ranges and faster charging times. Consequently, the batteries market is likely to benefit from increased demand for specialized batteries tailored for public transportation applications.

Government Incentives for Battery Production

The South Korean government has implemented various incentives to bolster the batteries market, particularly in the production of advanced battery technologies. These initiatives include financial subsidies, tax breaks, and research grants aimed at fostering innovation and competitiveness. In 2025, the government allocated approximately $1 billion to support battery research and development, which is expected to enhance local manufacturing capabilities. This strategic investment is likely to attract both domestic and foreign companies, thereby expanding the market landscape. As a result, the batteries market is poised for significant growth, driven by enhanced production capacities and technological advancements.

Technological Innovations in Battery Recycling

Technological advancements in battery recycling processes are emerging as a crucial driver for the batteries market in South Korea. As the country grapples with environmental concerns related to battery waste, innovative recycling technologies are being developed to recover valuable materials from used batteries. In 2025, it is estimated that the recycling market for batteries could reach $500 million, driven by both regulatory pressures and consumer awareness. This focus on sustainability not only mitigates environmental impact but also creates a circular economy within the batteries market, encouraging manufacturers to invest in eco-friendly practices and technologies.