Rising Demand for Packaging Solutions

the packaging sector is a significant driver for printing inks. With the increasing consumption of packaged goods, there is a corresponding rise in the demand for high-quality printing inks that enhance product visibility and appeal. The market for flexible packaging is particularly robust, with an estimated growth rate of 5% annually. This trend is largely attributed to the food and beverage industry, which seeks to improve shelf life and maintain product integrity. Additionally, the shift towards sustainable packaging solutions is prompting manufacturers to adopt inks that are not only visually appealing but also environmentally friendly. Consequently, the printing inks market is poised to benefit from this growing demand, as companies strive to innovate and meet consumer expectations.

Technological Advancements in Printing

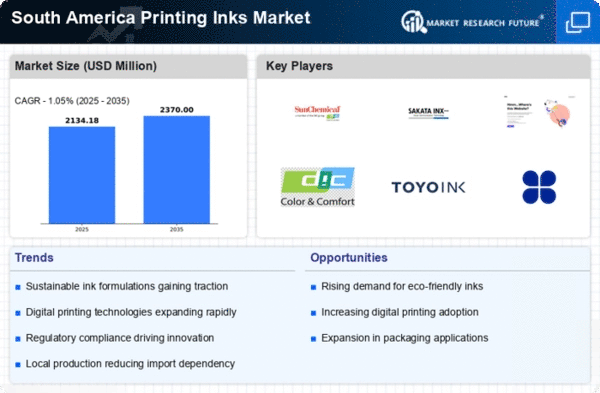

the market is experiencing a notable transformation due to rapid technological advancements. Innovations in ink formulations and printing techniques are enhancing print quality and efficiency. For instance, the introduction of eco-friendly inks is gaining traction, as they align with the growing demand for sustainable practices. The market is projected to grow at a CAGR of approximately 4.5% from 2025 to 2030, driven by these technological improvements. Furthermore, advancements in digital printing technologies are enabling faster production times and reduced waste, which are critical factors for businesses aiming to optimize their operations. As a result, companies in the printing inks market are increasingly investing in research and development to stay competitive and meet evolving consumer preferences.

Consumer Preferences for Aesthetic Appeal

Consumer preferences are evolving, with an increasing emphasis on aesthetic appeal in product packaging and printed materials. the market is responding to this trend by offering a diverse range of colors, finishes, and effects that cater to consumer desires for visually striking products. This shift is particularly evident in the cosmetics and personal care sectors, where packaging design plays a crucial role in attracting consumers. As brands strive to differentiate themselves in a competitive market, the demand for high-quality inks that enhance visual appeal is likely to rise. This trend suggests a robust growth trajectory for the printing inks market, as companies prioritize aesthetics in their product offerings to meet changing consumer expectations.

Expansion of E-commerce and Online Retail

The surge in e-commerce and online retail activities is significantly influencing the printing inks market in South America. As more businesses transition to online platforms, the need for effective packaging and branding becomes paramount. This shift is driving demand for high-quality inks that can withstand the rigors of shipping while maintaining aesthetic appeal. The e-commerce sector is projected to grow by over 20% in the coming years, which will likely lead to increased consumption of printing inks for packaging and promotional materials. Moreover, companies are focusing on creating unique and eye-catching designs to attract consumers in a crowded digital marketplace. This trend indicates a promising outlook for the printing inks market, as businesses invest in innovative solutions to enhance their brand presence.

Regulatory Compliance and Safety Standards

the market is increasingly influenced by stringent regulatory compliance and safety standards. Governments are implementing regulations to ensure that inks used in food packaging and other applications are safe for consumers. This has led to a growing demand for inks that meet these safety requirements, which is reshaping product offerings in the market. Companies are investing in developing inks that are compliant with local and international standards, thereby enhancing their marketability. The focus on safety is expected to drive growth in the printing inks market, as manufacturers seek to align their products with regulatory expectations. This trend not only promotes consumer safety but also encourages innovation in ink formulations, leading to a more competitive landscape.