Remote Work Trends

The rise of remote work in South America is reshaping the business software-services market. Companies are increasingly investing in collaboration and communication tools to support their remote workforce. This trend has led to a notable increase in the adoption of cloud-based software solutions, which facilitate seamless interaction among employees regardless of their location. Recent statistics indicate that the market for remote work software is expected to expand by 20% annually. As organizations continue to embrace flexible work arrangements, the business software-services market is likely to see sustained growth, driven by the need for effective remote work solutions.

E-commerce Expansion

The rapid expansion of e-commerce in South America is significantly impacting the business software-services market. As more businesses transition to online platforms, there is a growing demand for software solutions that support e-commerce operations, including payment processing, inventory management, and customer relationship management. Recent data suggests that e-commerce sales in the region are projected to reach $100 billion by 2026, indicating a robust growth trajectory. This surge in online retail is prompting businesses to invest in software services that enhance their digital capabilities, thereby driving the business software-services market forward.

Investment in IT Infrastructure

Investment in IT infrastructure is a critical driver of growth in the business software-services market in South America. As companies recognize the importance of robust IT systems, there is a marked increase in spending on software solutions that enhance operational capabilities. Recent reports indicate that IT spending in the region is expected to grow by 8% annually, with a significant portion allocated to software services. This investment is essential for businesses aiming to improve efficiency and scalability. Consequently, the business software-services market is likely to benefit from this trend, as organizations seek to modernize their IT infrastructure.

Digital Transformation Initiatives

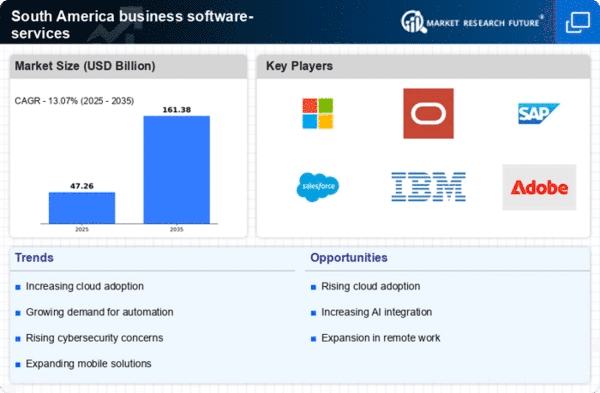

The ongoing digital transformation initiatives across various sectors in South America are driving the business software-services market. Organizations are increasingly adopting software solutions to enhance operational efficiency and customer engagement. According to recent data, the market is projected to grow at a CAGR of 12% over the next five years. This shift is largely fueled by the need for businesses to adapt to changing consumer behaviors and technological advancements. As companies invest in digital tools, the demand for software services that facilitate this transformation is expected to rise significantly. The business software-services market is thus positioned to benefit from these initiatives, as firms seek to leverage technology for competitive advantage.

Regulatory Compliance Requirements

Regulatory compliance is becoming increasingly stringent in South America, compelling businesses to adopt software solutions that ensure adherence to local laws and international standards. The business software-services market is witnessing a surge in demand for compliance management software, which helps organizations navigate complex regulatory landscapes. For instance, financial institutions are required to implement robust reporting systems to comply with anti-money laundering regulations. This has led to a projected increase in compliance software spending by approximately 15% in the coming years. As businesses prioritize compliance, the demand for specialized software services is likely to grow, further driving the market.