Innovations in Food Technology

Innovations in food technology are playing a crucial role in shaping the protein ingredients market in South Africa. Advances in processing techniques are enabling the development of new protein formulations that enhance taste, texture, and nutritional value. For instance, the introduction of microencapsulation technology allows for the effective delivery of protein in various food applications. This technological progress is likely to attract more consumers to protein-enriched products, as they become more appealing and accessible. As a result, the protein ingredients market is expected to benefit from these innovations, which could lead to increased product variety and improved consumer satisfaction.

Expansion of the Sports Nutrition Sector

The protein ingredients market in South Africa is witnessing substantial growth due to the expansion of the sports nutrition sector. With an increasing number of individuals engaging in fitness and athletic activities, the demand for protein supplements and fortified foods is rising. The sports nutrition segment is projected to grow at a CAGR of 15% over the next five years, indicating a robust market opportunity for protein ingredient suppliers. This growth is fueled by the rising popularity of fitness culture and the emphasis on performance enhancement, leading to a greater incorporation of protein ingredients in various products tailored for athletes and fitness enthusiasts.

Rising Health Consciousness Among Consumers

In South Africa, there is a marked increase in health consciousness among consumers, which is significantly influencing the protein ingredients market. As individuals become more aware of the importance of nutrition, the demand for high-protein products is on the rise. Recent surveys indicate that nearly 60% of South Africans are actively seeking protein-rich foods to enhance their diets. This trend is driving manufacturers to fortify their products with protein ingredients, thereby expanding their market reach. The protein ingredients market is thus positioned to benefit from this health-driven consumer behavior, as more people prioritize protein intake for its perceived health benefits.

Growing Demand for Sustainable Protein Sources

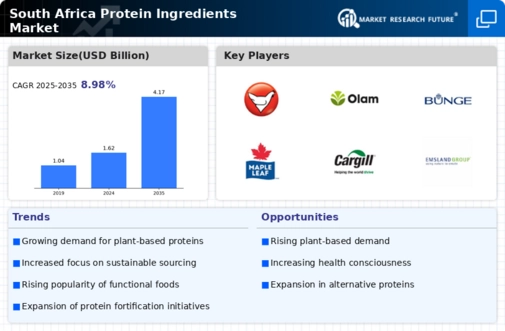

The protein ingredients market in South Africa is experiencing a notable shift towards sustainable protein sources. Consumers are increasingly aware of the environmental impact of their food choices, leading to a rise in demand for plant-based proteins. This trend is reflected in the market, where plant-based protein sales have surged by approximately 25% over the past year. The growing interest in sustainability is prompting manufacturers to innovate and develop new protein products that align with eco-friendly practices. As a result, the protein ingredients market is likely to see a diversification of offerings, catering to environmentally conscious consumers who prioritize sustainability in their dietary choices.

Influence of Dietary Trends and Lifestyle Changes

The protein ingredients market in South Africa is significantly influenced by evolving dietary trends and lifestyle changes. The rise of diets such as keto and paleo, which emphasize high protein intake, is driving demand for protein-rich ingredients. Additionally, the increasing prevalence of busy lifestyles is prompting consumers to seek convenient, protein-packed meal options. Recent data suggests that around 40% of South Africans are incorporating more protein into their diets due to these trends. Consequently, the protein ingredients market is likely to adapt by offering ready-to-eat and easy-to-prepare protein products, catering to the needs of health-conscious and time-strapped consumers.