Expanding mobile and internet penetration, especially in rural areas, and increasing adoption of e-commerce and online business models are driving market growth

The ICT and electronics industry in South Africa is well-developed and sophisticated, making a significant contribution to the country's GDP, driving the market CAGR. Major global players such as IBM, Unisys, Microsoft, Intel, SAP, Dell, Novell, and Compaq have established subsidiaries in South Africa, leveraging it as a regional center and supply base for neighboring nations. With the entry of more internet providers and improved bandwidth availability, security, and broadband pricing, cloud computing is gaining prominence. As of early 2023, South Africa had 43.48 million internet users, representing a penetration rate of 72%.

Social media users accounted for 25.80 million people, approximately 42.9% of the total population of 60 million. The number of internet users in the country increased by 357,000 (0.8%) compared to the same period in 2022. Additionally, there were 112.7 million active cellular mobile connections in South Africa, equivalent to 187.4% of the total population.

Online sales in South Africa surged by 66% from 2019 to 2020, reaching over $1.8 billion (ZAR30 billion). The top e-commerce product category in South Africa, after data and airtime, is clothing and apparel, followed by online entertainment. The e-commerce industry in South Africa is primarily divided into two sectors: fashion and toys, hobbies, and DIY. Fashion accounted for 32% of the total market value in 2022, followed by toys, hobbies, and DIY at 27%. Electronics and media, furniture and appliances, as well as food and personal care, represented 18%, 15%, and 8%, respectively.

The growth of online retail and e-commerce platforms is fueling demand for ICT solutions in areas such as online payments, digital marketing, logistics, and customer relationship management. Therefore, the market is expanding due to rising mobile and internet penetration, especially in rural areas, and Increasing adoption of e-commerce and online business models. Thus driving the ICT market revenue.

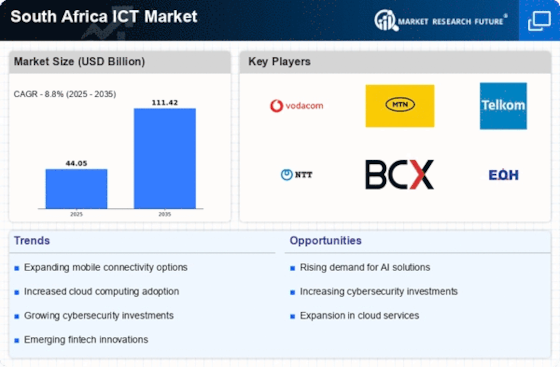

The South African ICT sector is poised for transformative growth, driven by increasing digital adoption and a burgeoning demand for innovative technological solutions across various industries.

Department of Communications and Digital Technologies, South Africa

Leave a Comment