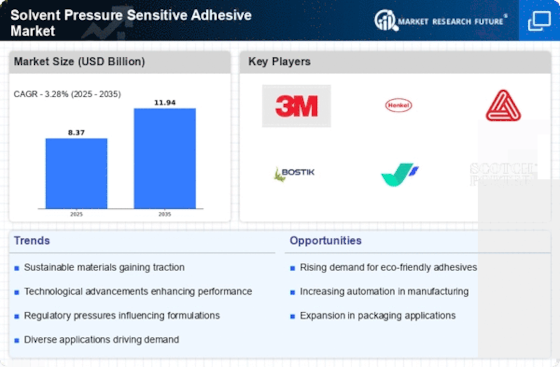

Rising Demand in Packaging Industry

The Solvent Pressure Sensitive Adhesive Market is experiencing a notable surge in demand, particularly from the packaging sector. This growth is driven by the increasing need for efficient and reliable adhesive solutions in various packaging applications, including food and beverage, consumer goods, and pharmaceuticals. As companies strive to enhance product safety and shelf life, the use of solvent-based adhesives has become more prevalent. According to recent data, the packaging industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, further propelling the demand for solvent pressure sensitive adhesives. This trend indicates a robust market potential for manufacturers and suppliers within the Solvent Pressure Sensitive Adhesive Market.

Expanding Applications in Electronics

The electronics industry is emerging as a key driver for the Solvent Pressure Sensitive Adhesive Market. With the proliferation of electronic devices, the need for reliable adhesive solutions in manufacturing and assembly processes is on the rise. Solvent pressure sensitive adhesives are utilized in various applications, including bonding components in smartphones, tablets, and other electronic devices. The increasing demand for lightweight and compact electronic products is further propelling the use of these adhesives. Market data suggests that the electronics sector is expected to grow at a CAGR of approximately 6% in the next few years, indicating a robust opportunity for solvent pressure sensitive adhesive manufacturers. This trend highlights the critical role of these adhesives in supporting the dynamic needs of the electronics market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Solvent Pressure Sensitive Adhesive Market. Governments and regulatory bodies are implementing stringent guidelines regarding the use of adhesives, particularly concerning VOC emissions and environmental impact. As a result, manufacturers are compelled to innovate and reformulate their products to meet these regulations. This shift towards compliance not only enhances product safety but also opens new avenues for market growth. Companies that proactively adapt to these regulations are likely to gain a competitive edge in the Solvent Pressure Sensitive Adhesive Market. The emphasis on safety and compliance is expected to drive demand for high-quality, low-emission solvent pressure sensitive adhesives.

Growth in Automotive and Construction Sectors

The automotive and construction sectors are significant contributors to the Solvent Pressure Sensitive Adhesive Market. The increasing use of adhesive solutions in vehicle assembly, interior applications, and construction materials is driving market growth. In the automotive sector, solvent pressure sensitive adhesives are utilized for bonding various components, enhancing structural integrity and reducing weight. Similarly, in construction, these adhesives are employed in flooring, wall coverings, and insulation applications. The automotive industry alone is projected to grow at a CAGR of around 5% in the coming years, which will likely bolster the demand for solvent pressure sensitive adhesives. This trend underscores the importance of these adhesives in supporting the evolving needs of the automotive and construction markets.

Technological Innovations in Adhesive Formulations

Technological advancements play a pivotal role in shaping the Solvent Pressure Sensitive Adhesive Market. Innovations in adhesive formulations, such as the development of high-performance and environmentally friendly solvents, are gaining traction. These advancements not only enhance the performance characteristics of adhesives but also address regulatory concerns regarding volatile organic compounds (VOCs). The introduction of new technologies, such as water-based and low-VOC solvent adhesives, is expected to expand the application scope of solvent pressure sensitive adhesives. As manufacturers invest in research and development, the market is likely to witness a shift towards more sustainable and efficient adhesive solutions, thereby driving growth in the Solvent Pressure Sensitive Adhesive Market.