- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

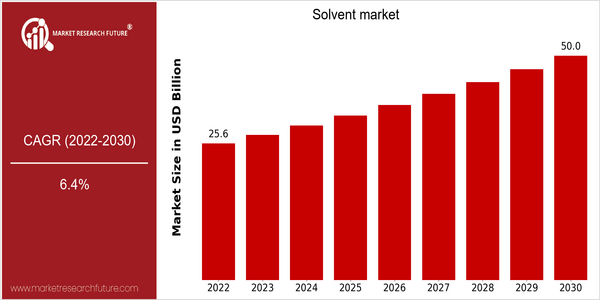

| Year | Value |

|---|---|

| 2022 | USD 25.6 Billion |

| 2030 | USD 50.01 Billion |

| CAGR (2022-2030) | 6.4 % |

Note – Market size depicts the revenue generated over the financial year

The market for solvents is estimated to be worth about $25.6 billion in 2022 and is expected to reach nearly $48 billion by the year 2030. This high growth rate is the result of a strong demand for solvents in various industries, driven by an increase in applications in the paints and coatings, pharmaceuticals, and adhesives sectors. These industries are growing, particularly in emerging economies. Also driving the growth of the solvent market is the development of new technology to formulate better solvents and the growing demand for sustainable and eco-friendly products. Bio-based and low-VOC alternatives are two such examples, which are in line with international regulations and consumer demand for greener solutions. The major players in the solvent market, such as BASF, The Dow Chemical Company, and ExxonMobil, are focusing on strategic initiatives such as research and development, and on forging new strategic alliances to stay ahead of the competition. These efforts not only meet the changing market requirements but also help these companies maintain their leading positions in the solvent market.

Regional Market Size

Regional Deep Dive

The solvents market is characterized by its varied applications in various industries, such as pharmaceuticals, paints and coatings, and cleaning products. In North America, the solvents market is driven by the growth of the manufacturing industry and the increasing demand for eco-friendly solvents. Europe is characterized by the increasing trend toward sustainable practices and the implementation of strict regulations that favor the use of bio-based solvents. In Asia-Pacific, the rapid industrialization is accompanied by a rise in solvent consumption. The Middle East and Africa are characterized by the growing oil and gas industries. Latin America is also becoming a significant player, with increasing investments in industry and manufacturing.

Europe

- The European Union's REACH regulation is driving the market towards safer and more sustainable solvent options, leading to increased research into non-toxic alternatives.

- Companies such as AkzoNobel are leading initiatives to develop water-based and low-VOC solvent solutions, aligning with the EU's environmental goals.

Asia Pacific

- China's rapid industrial growth has led to a surge in solvent demand, particularly in the automotive and electronics sectors, prompting local manufacturers to expand their production capacities.

- The Indian government is promoting the use of green solvents through initiatives like the National Policy on Biofuels, encouraging the development of bio-based solvent technologies.

Latin America

- Brazil is focusing on sustainable agricultural practices, which is increasing the demand for eco-friendly solvents in agrochemical formulations.

- Mexico's growing automotive industry is boosting the demand for solvents used in coatings and adhesives, leading to increased production capabilities.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new regulations aimed at reducing volatile organic compounds (VOCs) in solvents, pushing manufacturers to innovate towards greener alternatives.

- Major companies like Dow Chemical and BASF are investing in R&D for bio-based solvents, responding to consumer demand for sustainable products.

Middle East And Africa

- The oil and gas sector in the UAE is increasingly utilizing solvents for enhanced oil recovery processes, driving demand in the region.

- Saudi Arabia's Vision 2030 initiative is fostering diversification in the economy, leading to increased investments in chemical manufacturing, including solvents.

Did You Know?

“Did you know that approximately 80% of all solvents used in the world are derived from petroleum, but the market is increasingly shifting towards bio-based alternatives?” — International Solvents Association

Segmental Market Size

The market for solvents is stable, with a notable focus on the field of environmentally friendly and sustainable solvents. The main drivers of demand are the stricter regulations on volatile organic compounds (VOCs) and the increasing demand for green products. And the advances in formulation technology have led to the development of high-performance solvents that meet both the performance and the environment standards. The use of sustainable solvents has reached the stage of industrialization, with BASF and Dow leading the way. The main applications are in paints and coatings, adhesives, and cleaning agents. These solvents are very important in enhancing the performance of the products while reducing the impact on the environment. The trend toward sustainable development and the lowering of VOC emissions are expected to accelerate the growth of this segment. Bio-based solvents and solvent recovery systems are shaping the development of the market and delivering new solutions that meet the regulatory requirements and the consumers’ demands.

Future Outlook

The solvent market is expected to grow significantly from 2022 to 2030. It is estimated that the value of the market will rise from $25.6 billion to $50 billion, at a CAGR of 6.4%. This growth is mainly driven by the increasing demand from the pharmaceutical, paint and coating industries, which are increasingly dependent on solvents in their production processes. As these industries continue to expand, the solvent market is expected to increase in size and to have a greater impact on the environment. Especially in emerging economies where industrialization is accelerating, the use of solvents is expected to rise significantly. Also, a few important technological developments and regulatory policies are expected to drive the market. In particular, the shift towards eco-friendly and sustainable solvents, driven by stricter regulations and consumer preferences for greener products, is expected to have a significant impact on the market. The development of low-VOC and bio-based solvents is expected to increase, driven by the demand for safer and more sustainable solutions. The digital transformation of the manufacturing industry is also expected to lead to greater efficiency, which will in turn lead to the use of more advanced solvent formulations. The solvent market is expected to grow and change significantly, driven by the combination of industrial growth, technological innovation and a strong focus on the environment.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 25.6 billion |

| Growth Rate | 6.4 % (2022-2030) |

Solvent Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.