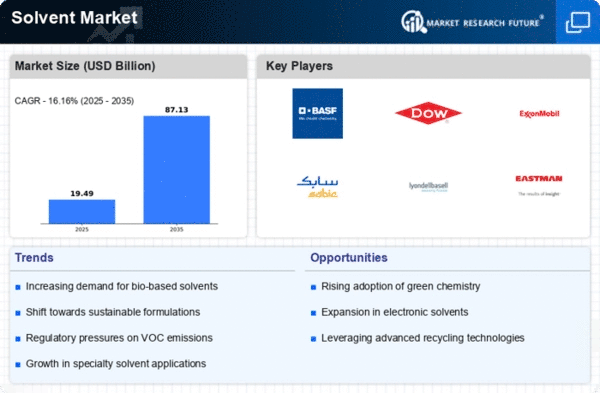

Market Growth Projections

The Global Solvent Market Industry is projected to experience substantial growth over the coming years. With a market value of 28.2 USD Billion in 2024, it is anticipated to reach 68.2 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 8.35% from 2025 to 2035. Such projections indicate a robust demand across various sectors, including automotive, pharmaceuticals, and paints and coatings. The increasing focus on sustainability and innovation within the industry further supports this positive outlook, suggesting that the Global Solvent Market Industry is well-positioned for future expansion.

Rising Demand in Automotive Sector

The Global Solvent Market Industry is experiencing a notable surge in demand from the automotive sector. As manufacturers increasingly prioritize the use of solvents for paint thinners, adhesives, and coatings, the market is projected to reach 28.2 USD Billion in 2024. This growth is driven by the automotive industry's shift towards more environmentally friendly products, which often require high-quality solvents for effective application. The increasing production of electric vehicles, which necessitate advanced coatings and adhesives, further propels this trend. Consequently, the automotive sector plays a pivotal role in shaping the future landscape of the Global Solvent Market Industry.

Increasing Environmental Regulations

The Global Solvent Market Industry is also shaped by increasing environmental regulations aimed at reducing volatile organic compounds (VOCs) emissions. Governments worldwide are implementing stricter guidelines to promote the use of low-VOC and eco-friendly solvents. This regulatory landscape is pushing manufacturers to innovate and develop greener alternatives, which could reshape the market dynamics. While this transition may present challenges, it also opens avenues for growth in the segment of sustainable solvents. As a result, the Global Solvent Market Industry may witness a shift towards more environmentally compliant products, aligning with global sustainability goals.

Growth in Paints and Coatings Industry

The Global Solvent Market Industry is poised for growth due to the expanding paints and coatings sector. Solvents are integral to the formulation of various paints, varnishes, and coatings, which are widely used in construction, automotive, and industrial applications. As urbanization accelerates and infrastructure development projects proliferate, the demand for high-quality coatings is expected to rise. This trend is likely to contribute to the market's compound annual growth rate of 8.35% from 2025 to 2035. The paints and coatings industry, therefore, represents a critical driver for the Global Solvent Market Industry, influencing both production and consumption patterns.

Expansion of Pharmaceutical Applications

The Global Solvent Market Industry is significantly influenced by the expansion of pharmaceutical applications. Solvents are essential in drug formulation, extraction processes, and as reaction media in pharmaceutical manufacturing. The increasing focus on developing new drugs and therapies, particularly in the wake of rising health concerns, is expected to bolster the market. With the pharmaceutical sector projected to grow substantially, the demand for solvents is likely to follow suit. This trend suggests that the Global Solvent Market Industry could see a marked increase in value, potentially aligning with the overall market growth forecast of 68.2 USD Billion by 2035.

Technological Advancements in Solvent Production

Technological advancements in solvent production are a key driver of the Global Solvent Market Industry. Innovations in extraction and purification processes enhance the efficiency and quality of solvents, making them more suitable for various applications. The adoption of advanced manufacturing techniques, such as green chemistry principles, is likely to improve production efficiency while minimizing environmental impact. These advancements not only cater to the growing demand for high-performance solvents but also align with the industry's shift towards sustainability. As a result, the Global Solvent Market Industry is expected to benefit from these technological developments, fostering growth and competitiveness.