Advancements in Smart Grid Technology

The evolution of smart grid technology is a significant catalyst for the Solid State Transformer Market. Smart grids enhance the efficiency and reliability of electricity distribution, necessitating advanced transformer solutions that can manage complex energy flows. Solid state transformers, with their ability to provide real-time monitoring and control, align perfectly with the requirements of smart grid systems. Market analysis suggests that investments in smart grid infrastructure are expected to reach approximately 100 billion dollars by 2026, indicating a robust growth trajectory. This investment is likely to drive demand for solid state transformers, which are essential for enabling two-way communication and improving grid resilience. As utilities adopt smart grid technologies, the Solid State Transformer Market stands to gain from the increasing need for innovative solutions that enhance operational efficiency and support renewable energy integration.

Increased Demand for Energy Efficiency

The rising emphasis on energy efficiency is a crucial driver for the Solid State Transformer Market. As energy costs continue to rise and environmental concerns become more pressing, industries and utilities are seeking solutions that minimize energy losses. Solid state transformers are designed to operate with higher efficiency compared to traditional transformers, potentially reducing energy waste significantly. Market data indicates that energy efficiency measures could save up to 1.2 trillion dollars globally by 2030, highlighting the economic benefits of adopting advanced technologies. This trend suggests that the Solid State Transformer Market is well-positioned to capitalize on the growing demand for energy-efficient solutions, as businesses and governments prioritize investments in technologies that enhance energy performance and sustainability.

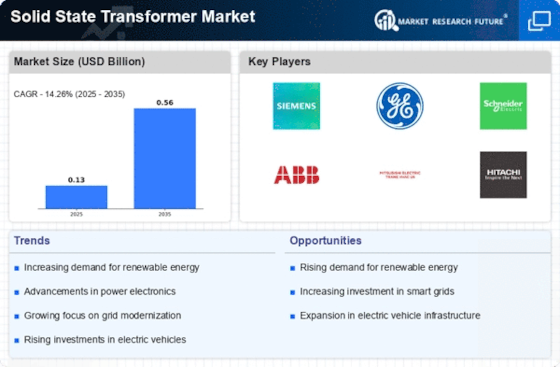

Growth in Electric Vehicle Infrastructure

The expansion of electric vehicle (EV) infrastructure is emerging as a key driver for the Solid State Transformer Market. As the adoption of electric vehicles accelerates, the demand for efficient charging solutions is becoming paramount. Solid state transformers offer advantages such as compact size, lightweight design, and enhanced efficiency, making them ideal for EV charging stations. Recent projections indicate that The Solid State Transformer Market is expected to grow at a compound annual growth rate of over 20% through the next decade, which will likely necessitate the deployment of advanced transformer technologies. This growth in EV infrastructure not only supports the transition to sustainable transportation but also creates opportunities for the Solid State Transformer Market to provide innovative solutions that meet the evolving needs of the energy landscape.

Integration with Renewable Energy Sources

The integration of renewable energy sources into the power grid is a pivotal driver for the Solid State Transformer Market. As nations strive to reduce carbon emissions, the demand for efficient energy conversion technologies has surged. Solid state transformers facilitate the seamless integration of solar and wind energy, enhancing grid stability and reliability. According to recent data, the renewable energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years, further propelling the need for advanced transformer technologies. This trend indicates a shift towards sustainable energy solutions, where solid state transformers play a crucial role in managing energy flow and optimizing resource utilization. The Solid State Transformer Market is thus positioned to benefit significantly from this transition, as utilities and energy providers seek innovative solutions to accommodate fluctuating energy inputs.

Regulatory Support for Clean Energy Initiatives

Regulatory frameworks supporting clean energy initiatives are increasingly influencing the Solid State Transformer Market. Governments worldwide are implementing policies aimed at promoting renewable energy adoption and reducing greenhouse gas emissions. These regulations often include incentives for the deployment of advanced technologies, such as solid state transformers, which facilitate the integration of renewable energy sources into the grid. Recent legislative measures indicate a commitment to achieving net-zero emissions by mid-century, which could drive substantial investments in clean energy infrastructure. This regulatory support is likely to create a favorable environment for the Solid State Transformer Market, as utilities and energy providers seek compliant and efficient solutions to meet evolving energy demands and sustainability goals.