Government Incentives and Policies

Government incentives and supportive policies play a crucial role in driving the Solar Panel Coatings Market. Many countries have implemented tax credits, rebates, and grants to encourage the adoption of solar energy technologies. For example, the Investment Tax Credit in the United States has significantly boosted solar installations, leading to increased demand for solar panels and their coatings. Furthermore, regulatory frameworks aimed at reducing carbon emissions are pushing industries to adopt cleaner energy solutions. As a result, the Solar Panel Coatings Market is likely to benefit from these favorable policies, which stimulate growth and innovation in coating technologies.

Rising Demand for Renewable Energy

The increasing The Solar Panel Coatings Industry. As nations strive to meet energy demands sustainably, solar energy has emerged as a viable alternative. The International Energy Agency projects that solar power could account for nearly 20% of global electricity generation by 2040. This surge in solar energy adoption necessitates the use of advanced coatings that enhance efficiency and durability. Consequently, manufacturers are focusing on developing innovative coatings that can withstand environmental stressors while maximizing energy output. The growing demand for solar panels directly correlates with the need for effective coatings, thereby propelling the Solar Panel Coatings Market forward.

Growing Awareness of Energy Efficiency

The rising awareness of energy efficiency among consumers and businesses is a significant driver for the Solar Panel Coatings Market. As energy costs continue to rise, there is a growing emphasis on maximizing the efficiency of solar panels. Coatings that enhance light absorption and reduce reflection are becoming increasingly popular, as they can significantly improve the overall performance of solar installations. Market Research Future indicates that energy-efficient coatings can lead to a 15 to 20% increase in energy output. This heightened focus on energy efficiency is likely to propel the demand for specialized coatings, thereby fostering growth within the Solar Panel Coatings Market.

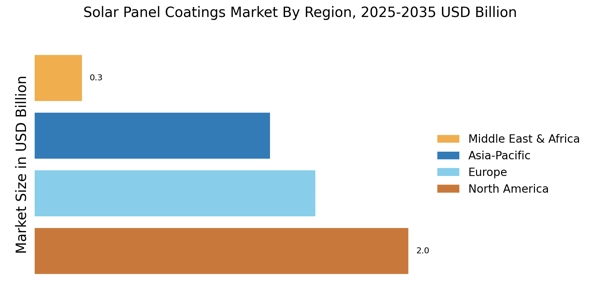

Expansion of Solar Energy Infrastructure

The expansion of solar energy infrastructure is a vital driver for the Solar Panel Coatings Market. As more countries invest in solar farms and residential solar installations, the demand for high-quality coatings is expected to rise. The Solar Panel Coatings Market is projected to grow at a compound annual growth rate of over 20% in the coming years. This expansion necessitates the development of coatings that can withstand various environmental conditions while maintaining optimal performance. Consequently, manufacturers are likely to focus on creating durable and efficient coatings, which will further stimulate growth in the Solar Panel Coatings Market.

Technological Innovations in Coating Materials

Technological advancements in coating materials significantly influence the Solar Panel Coatings Market. Innovations such as nanotechnology and hydrophobic coatings have emerged, enhancing the performance and longevity of solar panels. For instance, self-cleaning coatings, which utilize hydrophobic properties, can reduce maintenance costs and improve energy efficiency by keeping panels free from dirt and debris. According to recent studies, these advanced coatings can increase energy output by up to 10%. As manufacturers continue to invest in research and development, the introduction of new materials and technologies is likely to reshape the Solar Panel Coatings Market, making it more competitive and efficient.