- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

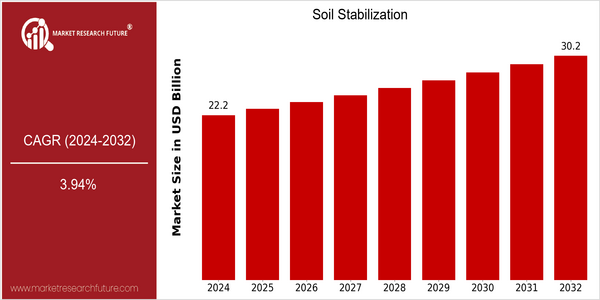

| Year | Value |

|---|---|

| 2024 | USD 22.17096 Billion |

| 2032 | USD 30.2 Billion |

| CAGR (2024-2032) | 3.94 % |

Note – Market size depicts the revenue generated over the financial year

The global soil stabilization market is poised for steady growth, with a current market size of approximately USD 22.17 billion in 2024, projected to reach USD 30.2 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.94% over the forecast period. The increasing demand for sustainable construction practices and the need for improved infrastructure are key drivers of this market expansion. As urbanization accelerates and the construction industry seeks to enhance soil performance, innovative soil stabilization technologies are gaining traction, contributing to the overall market growth. Technological advancements, such as the development of eco-friendly stabilizers and the integration of smart materials, are further propelling the market forward. Companies like BASF SE, GRT, and Soil Stabilization Products, LLC are at the forefront of these innovations, actively engaging in strategic partnerships and investments to enhance their product offerings. For instance, recent product launches focusing on bio-based stabilizers and the adoption of advanced machinery for soil treatment are indicative of the industry's shift towards more sustainable and efficient solutions. As these trends continue to evolve, the soil stabilization market is expected to maintain its upward momentum, driven by both environmental considerations and the need for resilient infrastructure.

Regional Market Size

Regional Deep Dive

The Soil Stabilization Market is experiencing significant growth across various regions, driven by increasing infrastructure development, urbanization, and the need for sustainable construction practices. In North America, the market is characterized by advanced technology adoption and a strong focus on environmental regulations. Europe is witnessing a surge in eco-friendly soil stabilization methods, while Asia-Pacific is rapidly expanding due to urbanization and industrialization. The Middle East and Africa are focusing on infrastructure projects, and Latin America is leveraging soil stabilization for agricultural improvements and road construction. Each region presents unique dynamics influenced by local regulations, economic conditions, and cultural factors.

Europe

- The European Union's Green Deal is pushing for sustainable construction practices, leading to increased investment in soil stabilization technologies that minimize carbon footprints.

- Companies such as Soil Stabilization Products LLC are developing bio-based stabilizers, aligning with the region's focus on sustainability and innovation in construction materials.

Asia Pacific

- Rapid urbanization in countries like India and China is driving the demand for soil stabilization in road construction and infrastructure projects, with significant investments from governments.

- Innovations in geosynthetics by companies like TenCate Geosynthetics are enhancing soil stabilization methods, making them more efficient and cost-effective for large-scale projects.

Latin America

- Brazil's government is investing in infrastructure projects that incorporate soil stabilization techniques to improve road quality and reduce maintenance costs.

- Innovative practices in agricultural soil stabilization are being adopted in Argentina, enhancing crop yields and soil health, which is crucial for the region's economy.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new guidelines promoting the use of sustainable materials in construction, which is driving demand for eco-friendly soil stabilization solutions.

- Key players like GRT (Global Road Technology) are innovating with polymer-based soil stabilizers that enhance durability and reduce environmental impact, setting new industry standards.

Middle East And Africa

- The UAE's Vision 2021 initiative is promoting infrastructure development, leading to increased adoption of soil stabilization techniques in road and building projects.

- Local firms are collaborating with international companies to implement advanced soil stabilization technologies, improving project efficiency and sustainability.

Did You Know?

“Soil stabilization can reduce the need for traditional construction materials by up to 30%, significantly lowering project costs and environmental impact.” — International Society for Soil Mechanics and Geotechnical Engineering

Segmental Market Size

The Soil Stabilization Market is currently experiencing growth, driven by increasing infrastructure development and the need for sustainable construction practices. Key factors propelling demand include the rising emphasis on road safety and durability, as well as regulatory policies promoting environmentally friendly construction methods. Additionally, technological advancements in stabilization materials, such as the use of biopolymers and geosynthetics, are enhancing performance and efficiency in soil stabilization processes. Currently, the market is in a phase of scaled deployment, with notable adoption in regions like North America and Europe, where companies such as GRT and Soil Stabilization Products, LLC are leading the charge. Primary applications include road construction, airport runways, and land reclamation projects, where effective soil stabilization is crucial for structural integrity. Trends such as government mandates for sustainable practices and increased investment in infrastructure are catalyzing growth. Furthermore, innovative technologies like drone surveying and real-time monitoring systems are shaping the evolution of soil stabilization, ensuring better project outcomes and resource management.

Future Outlook

The soil stabilization market is poised for significant growth from 2024 to 2032, with a projected market value increase from approximately $22.17 billion to $30.2 billion, reflecting a compound annual growth rate (CAGR) of 3.94%. This growth trajectory is underpinned by the increasing demand for sustainable construction practices and the need for enhanced infrastructure resilience in the face of climate change. As urbanization accelerates globally, the necessity for effective soil stabilization solutions will become more pronounced, particularly in developing regions where infrastructure development is critical. By 2032, it is anticipated that the penetration of advanced soil stabilization technologies will reach upwards of 25% in new construction projects, driven by both regulatory frameworks and market demand for environmentally friendly practices. Key technological advancements, such as the development of bio-based stabilizers and innovative polymer solutions, are expected to reshape the landscape of soil stabilization. These technologies not only improve the performance and longevity of stabilized soils but also align with global sustainability goals. Additionally, government policies promoting green construction and infrastructure investment will further catalyze market growth. Emerging trends, including the integration of smart technologies in soil stabilization processes and the increasing adoption of recycled materials, will also play a crucial role in enhancing the efficiency and effectiveness of soil stabilization methods. As the market evolves, stakeholders must remain agile to leverage these trends and capitalize on the growing opportunities within the sector.

Soil Stabilization Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.