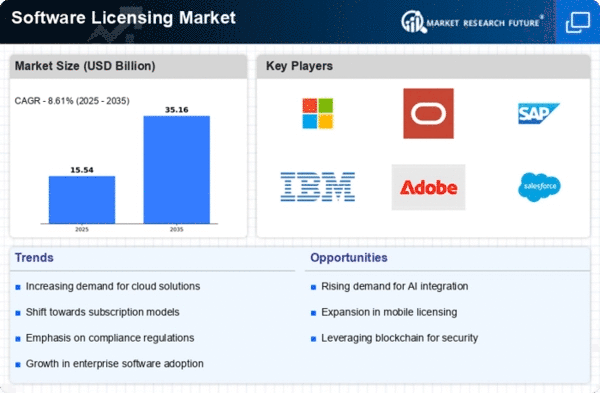

Top Industry Leaders in the Software Licensing Market

Competitive Landscape of the Software Licensing Market:

The software licensing market is a dynamic and evolving space, fueled by the exponential growth of the software industry itself. With diverse licensing models, from perpetual to subscription-based, catering to varied user needs and business models, understanding the competitive landscape is crucial for both established players and new entrants. This overview delves into the key players, their strategies, market share analysis factors, emerging players, and current investment trends.

Key Players:

- Flexera Software (US)

- IBM Corporation (US)

- Muduslink Global Solutions Inc. (US)

- Inishtech Technology Ventures Ltd. (Ireland)

- Microsoft Corporation (US)

- Accenture Plc. (Ireland)

- Safenet Inc. (US)

- Agilis International (US)

- Dimension Data (South Africa)

- HP Inc (US)

- Vector Networks (US)

- DXC Technology Company (US)

- Gemalto MV (Netherlands)

- Reprise Software (US)

- Snow Software (Sweden)

Strategies Adopted:

- Diversification of Licensing Models: Moving beyond traditional perpetual licenses, players are actively offering subscription-based options, freemium models, and usage-based pricing to cater to diverse user segments and market demands.

- Focus on Innovation: Continuous R&D efforts are essential to create secure, user-friendly licensing solutions that support agile deployment models and integrate seamlessly with cloud environments.

- Partnership and Acquisition: Collaboration with cloud providers, technology partners, and system integrators strengthens market reach and expertise. Strategic acquisitions of specialized solution providers expand portfolio offerings and enhance competitive advantage.

- Customer-Centric Approach: Delivering excellent customer service, technical support, and training resources fosters user satisfaction and long-term loyalty, thereby securing recurring revenue streams.

Factors for Market Share Analysis:

- Product Portfolio Breadth: The variety of software and licensing models offered determines the player's ability to cater to different user segments and vertical markets.

- Brand Recognition and Reputation: Established brands and trusted vendors hold an edge in attracting new customers, while a positive reputation for security and reliability strengthens market share.

- Compliance and Legal Expertise: Deep understanding of licensing regulations and compliance requirements assures users and builds trust, attracting organizations with complex compliance needs.

- Pricing Strategies and Competitiveness: Flexible pricing options, competitive discounts, and attractive bundled packages can influence user decisions and drive market share gains.

- Channel Partnerships and Distribution Network: Strong relationships with resellers, distributors, and technology partners expand market reach and facilitate wider product adoption.

New and Emerging Companies:

- Cloud-Native SaaS Providers: Startups offering innovative SaaS solutions with flexible subscription models are disrupting established markets, attracting digitally-savvy customers.

- Open-Source Licensing Specialists: New players focusing on open-source licensing models and community-driven development are gaining traction, offering cost-effective alternatives to traditional proprietary software.

- Micro-Services Licensing Vendors: Companies specializing in granular licensing models for microservices architectures are emerging to address the needs of cloud-native development.

Current Company Investment Trends:

- Focus on Automation and AI: Investments in AI-powered solutions for license optimization, compliance automation, and fraud detection are on the rise.

- Cloud-Based License Management Platforms: Development of cloud-based SLM platforms offering remote license management, usage visibility, and cost control is a priority.

- Integration with DevOps and IT Automation Tools: Seamless integration with existing DevOps and IT automation tools ensures streamlined software delivery and license compliance.

- Security and Data Privacy Enhancements: Investments in advanced security measures and data encryption technologies are crucial to address growing cybersecurity concerns.

Recent Developments:

- Microsoft's new licensing policy: Microsoft recently introduced a new licensing policy for its Azure cloud platform, simplifying pricing and offering more flexibility for customers. (Jan 25, 2024)

- Open source licensing debate: The debate over open source licensing models continues, with some advocating for stricter enforcement of copyleft licenses like the GNU General Public License (GPL) to protect software freedoms. (Jan 20, 2024)

- Copyright infringement lawsuits: Software piracy remains a challenge, with several high-profile copyright infringement lawsuits against companies for unauthorized software use. (Jan 17, 2024)

Emerging Trends:

- Usage-based pricing: Pay-per-use pricing models are gaining traction, offering cost-efficiency for customers with variable software usage. (Dec 2023)

- License management platforms: The demand for license management platforms is increasing as companies struggle to manage complex software licenses and ensure compliance. (Jan 10, 2024)

- Blockchain for license verification: Blockchain technology is being explored for its potential to securely verify software licenses and prevent piracy. (Jan 5, 2024)