Software engineering Market Summary

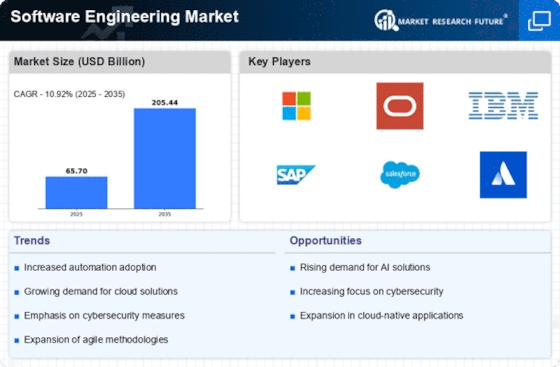

As per Market Research Future analysis, the Software Engineering Market Size was estimated at 65.7 USD Billion in 2024. The Software Engineering industry is projected to grow from 72.87 USD Billion in 2025 to 205.44 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.92% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Software Engineering Market is experiencing robust growth driven by technological advancements and evolving methodologies.

- Agile methodologies are increasingly adopted across various sectors, enhancing project efficiency and responsiveness.

- Cloud computing continues to reshape software delivery models, facilitating scalability and flexibility for businesses.

- Artificial intelligence integration is becoming a cornerstone in software development, streamlining processes and improving outcomes.

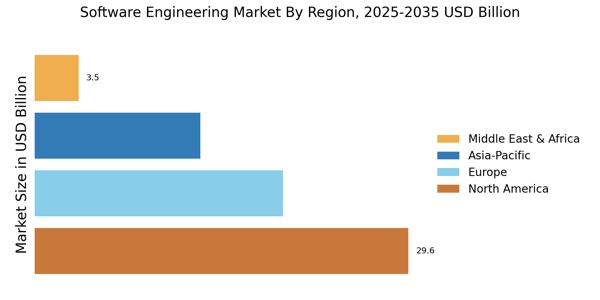

- The increased demand for software solutions and the adoption of DevOps practices are key drivers propelling growth in North America and Asia-Pacific, particularly in the 3D Modelling and Plant Design segments.

Market Size & Forecast

| 2024 Market Size | 65.7 (USD Billion) |

| 2035 Market Size | 205.44 (USD Billion) |

| CAGR (2025 - 2035) | 10.92% |