Top Industry Leaders in the Software Defined Networking Market

The Competitive Landscape of the Software Defined Networking (SDN) Market:

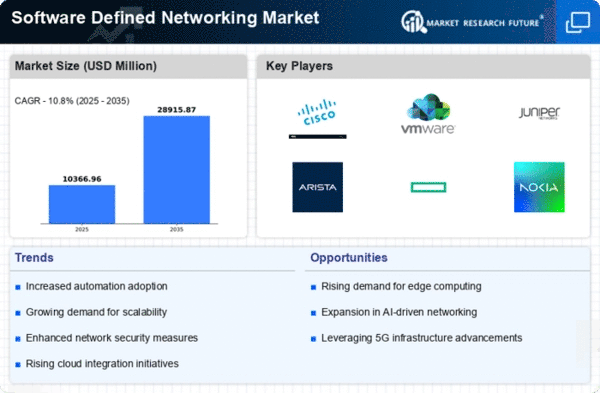

The Software Defined Networking (SDN) market is experiencing explosive growth, driven by the burgeoning demand for agility, scalability, and automation in network infrastructure. It's no surprise that the competitive landscape is fiercely dynamic. This report delves into the intricate tapestry of key players, their strategies, market share determinants, emerging players, and current investment trends.

Key Players:

- Intel Corporation

- Pluribus Networks Inc. (U.S.)

- Hewlett Packard Enterprise Company (U.S.)

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc. (U.S.)

- Juniper Networks Inc. (U.S.)

- NEC Corporation (Japan)

- Pica8 Inc. (U.S.)

- IBM Corporation

Strategies Adopted for Market Dominance:

- Product Innovation: Continuous development of SDN controllers, OpenFlow support, and network automation tools are crucial for staying ahead. VMware's NSX-T Data Center and Cisco's ACI with Intent-Based Networking are prime examples.

- Partnerships and Acquisitions: Strategic partnerships with network equipment providers and cloud providers are key to expanding reach and expertise. Cisco's partnership with Ericsson and VMware's acquisition of Heptio are recent examples.

- Open-Source Collaboration: Engagement with open-source communities like ONF and OpenDaylight fosters faster innovation and broader ecosystem adoption. Pluribus Networks heavily leverages open-source code within Netvisor.

Factors Shaping Market Share Analysis:

- Breadth of Solution Portfolio: Offering a comprehensive suite of SDN controllers, switches, and orchestration tools attracts larger customers with complex network needs.

- Vertical Specializations: Targeting specific industries like healthcare or finance with tailored SDN solutions can offer a competitive edge.

- Ease of Deployment and Management: User-friendly interfaces and automation capabilities simplify network management and attract less-technical users.

- Pricing Flexibility: Subscription-based models and open-source options cater to diverse budgets and deployment models.

New and Emerging Companies:

- Intent-Based Networking (IBN) Players: IBN solutions like Absicht and Infoblox automate network configuration based on user intent, simplifying management further.

- Security-Focused Startups: Guardicore and Nutanix Flow are focused on integrating security seamlessly into SDN architectures, addressing a critical market need.

- SD-WAN Startups: Cato Networks and Silver Peak are leveraging SDN principles to provide agile and cost-effective WAN solutions for distributed enterprises.

Current Investment Trends:

- Focus on Automation and Orchestration: Companies are investing heavily in tools that automate network provisioning, configuration, and troubleshooting.

- Integration with Cloud and Multi-Cloud Environments: Seamless integration with cloud platforms and support for multi-cloud deployments are essential for future-proofing SDN solutions.

- Security and Compliance: Embedding robust security features and aligning with evolving compliance regulations are critical for market trust and adoption.

Latest Company Updates:

October 26, 2023, Cisco announced its intent to acquire Acacia Communications, a provider of optical networking technology. This move will strengthen Cisco's SDN portfolio and enable them to offer more comprehensive network solutions.

December 12, 2023, The Open Networking Foundation (ONF) announced the release of OpenDaylight Tungsten v4.0, the latest version of its open-source SDN controller platform. This release includes new features for network automation and security.

January 9, 2024, Juniper Networks announced the launch of its new Apstra platform, a cloud-based SDN solution for managing data center networks. Apstra promises to simplify network operations and reduce costs.