Growing Geriatric Population

The expanding geriatric population is a significant driver for the Soft Mist Inhalers Market. Older adults are more susceptible to respiratory diseases, necessitating effective inhalation therapies. Soft mist inhalers, with their user-friendly designs and efficient drug delivery mechanisms, are particularly well-suited for this demographic. As the global population ages, the demand for respiratory care solutions is expected to rise, leading to increased adoption of soft mist inhalers among elderly patients. This trend is likely to contribute to the overall growth of the Soft Mist Inhalers Market, as healthcare providers seek to offer effective treatment options tailored to the needs of older adults.

Supportive Regulatory Frameworks

Supportive regulatory frameworks are crucial for the growth of the Soft Mist Inhalers Market. Regulatory bodies are increasingly recognizing the importance of innovative inhalation devices in improving patient outcomes. Streamlined approval processes for new inhalation technologies facilitate quicker market entry, allowing manufacturers to introduce advanced soft mist inhalers to meet patient needs. Additionally, regulatory support for research and development initiatives encourages innovation within the industry. As regulations evolve to accommodate new technologies, the Soft Mist Inhalers Market is likely to benefit from increased investment and development of novel inhalation solutions, further driving market growth.

Increased Awareness and Education

The growing awareness and education regarding respiratory health and the benefits of soft mist inhalers are significant drivers for the Soft Mist Inhalers Market. Healthcare campaigns and patient education initiatives have been instrumental in informing patients about the advantages of using soft mist inhalers, such as improved medication delivery and ease of use. This heightened awareness is likely to lead to increased adoption rates among patients, particularly those who may have previously struggled with traditional inhalers. As more individuals become informed about their treatment options, the demand for soft mist inhalers is expected to rise, contributing to the overall growth of the Soft Mist Inhalers Market.

Rising Prevalence of Respiratory Diseases

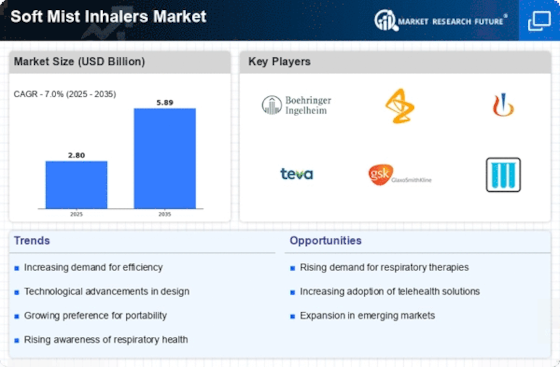

The increasing incidence of respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD) is a primary driver for the Soft Mist Inhalers Market. According to recent data, respiratory diseases affect millions of individuals worldwide, leading to a growing demand for effective treatment options. Soft mist inhalers, known for their ability to deliver medication in a fine mist, enhance drug deposition in the lungs, which is crucial for patients with compromised respiratory function. This trend is likely to continue, as healthcare providers increasingly recognize the benefits of soft mist inhalers over traditional inhalation devices. The Soft Mist Inhalers Market is expected to expand as more patients seek these advanced inhalation therapies to manage their conditions effectively.

Technological Innovations in Inhalation Devices

Technological advancements play a pivotal role in shaping the Soft Mist Inhalers Market. Innovations such as improved aerosol delivery systems and user-friendly designs have made soft mist inhalers more appealing to patients and healthcare professionals alike. These devices are engineered to provide a consistent and efficient delivery of medication, which is essential for effective treatment. The integration of smart technology, such as dose counters and connectivity features, further enhances patient adherence and monitoring. As the market evolves, the introduction of novel inhalation technologies is likely to drive growth, making soft mist inhalers a preferred choice among patients and clinicians. The Soft Mist Inhalers Market is poised for expansion as these innovations continue to emerge.