Market Analysis

In-depth Analysis of Sodium Sulfur Battery Market Industry Landscape

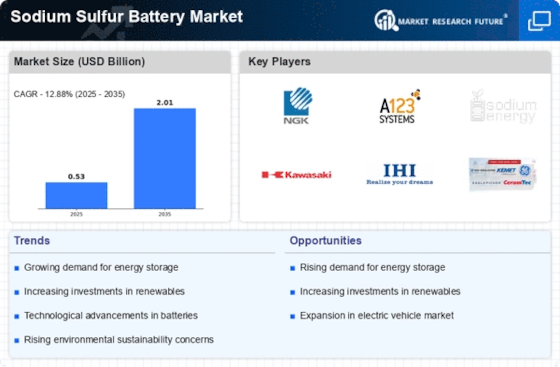

The global market of sodium sulfur battery can be categorized into power rating, application, and region. In terms of power rating, the market is divided into less than 10 MW, 11-25 MW, 26-50 MW and above 50 MW. The leading segment in the market is 26-50MW because more electric utilities are becoming interested in this type of battery which serves them purpose of a grid energy storage solution for renewable sources of energy on grid. Additionally, these batteries are characterized by high current density; long cycle life and large scale manufacturing schemes that simplify commercialization processes.

One way or another this market experiences growth due to rising interest in integration with other renewable power supplies markets. The desire for secure energy supply becomes very important as we shift towards sustainable energy economies all over the world. They are designed particularly so that they have found applications where it’s necessary to store huge amounts of energy over a long period making them helpful in addressing intermittent renewable-energy concerns in growing storage space sector.

Sodium-Sulfur Battery Market Growth Driven By Increasing Focus On Electric Mobility: Electric vehicles (EVs) require advanced battery technologies that offer high energy density, fast charging capabilities, and long cycle life.Sodium-sulfur batteries could serve as the answer to electric vehicles’ advances in energy density, shorter charging time and longer life cycle specifically in applications with no weight limitations such as electric buses and some types of industrial vehicles.

Sodium-sulfur batteries are gaining interest as they have the potential to address grid stability and reliability concerns associated with renewable energy. The increase in renewable energy sources that are intermittent like wind power and solar increases calls for need for energy storage systems that can offer steady power supply. Sodium-sulfur batteries have a great advantage because of their ability to store large amounts of energy which can be discharged over long periods so as to overcome the challenges posed by fluctuating outputs from these various renewable sources.

Cost competitiveness is one of the factors that influence market dynamics of sodium sulfur batteries versus other energy storage technologies. By scale economies, improvements in production techniques, and material inventions; manufacturers aim at reducing costs for sodium-sulphur battery production. With falling prices for sodium sulfur batteries, they become more competitive against a wider range of uses thereby driving further growth in terms of demand.

Sodium-Sulfur Battery Market Driven By Energy Security Concerns And Reliable Backup Power Systems: These battery packs combine a high powered density with uninterrupted power supply during grid outages making them suitable for example in telecommunication centers data centers among others.

In conclusion, there is an increased demand for these types of batteries due to such factors as; grid stability, electrification of transportation and renewable integration. Technological advancements, government policies, growth of electric mobility, grid reliability concerns, cost competitiveness, energy security needs and global trends in decarbonization are some of the key drivers behind the dynamic and expanding Sodium-Sulfur Battery market. Therefore because this is a fast evolving market it calls for companies that can innovate align with sustainability goals as well as address various applications for them to thrive.

Leave a Comment