Top Industry Leaders in the Sodium Sulfur Battery Market

*Disclaimer: List of key companies in no particular order

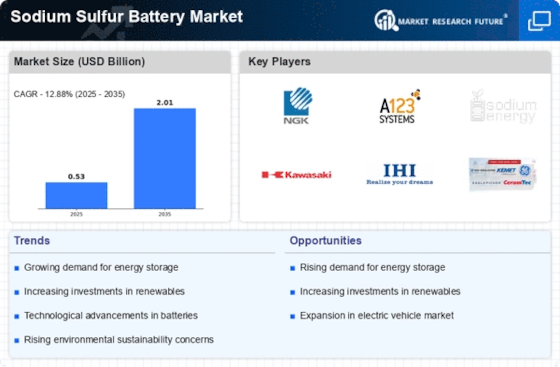

The sodium-sulfur (NaS) battery market, though currently occupying a niche, presents a substantial opportunity to revolutionize grid-scale energy storage. In addressing the safety, cost, and scalability limitations of lithium-ion batteries, the NaS market is witnessing intense competition from both established players and startups. This comprehensive report delves into the competitive landscape, examining key player strategies, market share influencers, and emerging trends that are shaping the future trajectory of this dynamic market.

Key Players and Strategies: The market is home to influential players such as NGK Insulators Ltd., KEMET Electronics Corporation, GE Energy Storage, Eagle Picher Technologies LLC, Ceramatec Inc., Sieyuan Electric Co. Ltd., FIAMM Group, POSCO, and others. Each player brings a unique approach to the table.

NGK Insulators Ltd. (Japan), the undisputed leader, commands a remarkable 90% market share and has extensive experience in NaS technology. Their strategic focus revolves around optimizing manufacturing processes, reducing costs, and expanding into new geographical markets.

Hi-Tech Energy Systems (USA), an established player catering primarily to the U.S. market, specializes in large-scale energy storage solutions for grids and utilities. Their strategy includes forging strategic partnerships and collaborations to enhance market reach and product development.

Redflow Ltd. (Australia) targets niche applications like off-grid and microgrid deployments with their ZCell line of long-duration NaS batteries. Their strengths lie in innovation in design and modularity.

Enovix Corp. (USA), a rising star, leverages its patented PureCathode™ technology to develop high-performance and cost-competitive NaS batteries. Aggressive partnerships and strategic acquisitions are the driving forces behind their growth.

Other significant players, such as Flux Energy (U.S.), Chinese players like HiNa Battery and CATL, and European research consortiums, contribute to the dynamism of the competitive landscape by actively developing and commercializing NaS solutions.

Market Share Analysis: Factors at Play: Several factors beyond mere brand recognition influence market share dynamics in the NaS battery market:

Emerging Trends and Innovation: Several exciting trends are shaping the future of the NaS battery market:

Overall Competitive Scenario: The NaS battery market is at a crucial juncture, transitioning from early adoption to wider commercialization. Fierce competition prevails, with established players facing challenges from innovative startups and rising competition from Chinese manufacturers. While cost remains a crucial barrier, technological advancements, supportive regulatory environments, and increasing demand for grid-scale energy storage solutions indicate a promising future for NaS batteries.

Companies that successfully overcome cost hurdles, demonstrate technological leadership, and build strong partnerships across the value chain will be well-positioned to capture a significant share of this rapidly growing market. The coming years are likely to witness consolidation, strategic alliances, and increased investments in research and development, further shaping the competitive landscape and propelling the NaS battery market towards mainstream adoption.

Industry Developments and Latest Updates: As of October 26, 2023:

As of May 17, 2023:

As of July 11, 2023:

As of February 28, 2023: