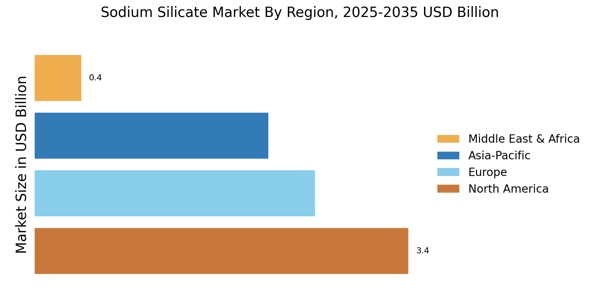

North America: Mature and Steady Market

North America represents a mature and steady sodium silicate market, driven primarily by established demand across detergents, water treatment, pulp & paper, and precipitated silica applications. The United States leads the market, supported by advanced manufacturing infrastructure and robust regulatory frameworks. Growth is largely centered on investments to upgrade water infrastructure, the extensive use of sodium silicate as a corrosion inhibitor, and sustained household and industrial cleaning product consumption. While overall market expansion is moderate, the demand for high-purity, specialty grades continues to support value-added applications and innovation in the region.

Europe

Europe maintains a competitive sodium silicate market characterized by strong regulatory oversight and high environmental standards. Growth is supported by demand from precipitated silica, construction materials, detergents, and specialty industrial applications. The region emphasizes sustainable manufacturing, recycled paper processing, and green tire production, driving demand for high-quality, low-VOC sodium silicate products. Technological advancement and process efficiency remain critical to maintaining competitiveness, ensuring steady market expansion despite stringent regulations.

Asia-Pacific: Largest and Fastest-Growing Market

Asia-Pacific is both the largest and fastest-growing sodium silicate market globally, fueled by rapid industrialization, urbanization, and infrastructure development. High population growth, rising hygiene awareness, and expansive mega-projects drive demand across detergents, construction, precipitated silica, pulp & paper, and water treatment applications. The region’s cost-competitive production capabilities and abundant raw material availability enhance domestic consumption and export potential, positioning Asia-Pacific as the central hub for sodium silicate growth. China and India are key contributors, with ongoing investments supporting both industrial and household demand.

South America

South America’s sodium silicate market is moderately growing, with demand primarily concentrated in Brazil due to its sizable industrial base and infrastructure projects. Growth is supported by detergents, construction, pulp & paper, and water treatment applications. Price sensitivity drives consumption patterns, though increasing local production capacity and reduced reliance on imports are gradually strengthening market development. Economic recovery, industrial modernization, and investment in water and sanitation projects further support steady expansion in the region.

Middle East & Africa: Emerging Market

The Middle East and Africa region is an emerging market for sodium silicate, driven by growing construction activity, urbanization, and water treatment needs. The Middle East, in particular, shows rising demand due to investments in desalination, water management, and large-scale infrastructure projects. South Africa contributes primarily through detergents, construction, and industrial applications. While infrastructure and logistics challenges persist, ongoing industrialization and government-led development programs provide a strong foundation for long-term market growth