Socks Size

Market Size Snapshot

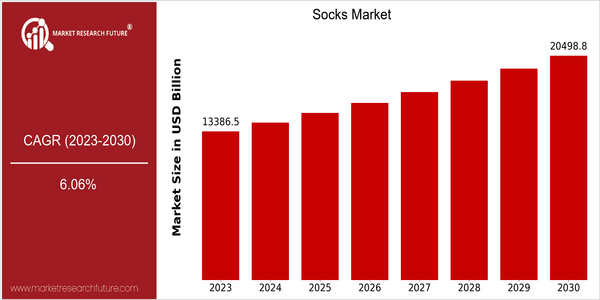

| Year | Value |

|---|---|

| 2023 | USD 13386.54 Billion |

| 2030 | USD 20498.82 Billion |

| CAGR (2023-2030) | 6.06 % |

Note – Market size depicts the revenue generated over the financial year

The world market for socks is poised for significant growth, with a current value of $13,386,543 in 2023, expected to reach $20,498,828 by 2030. This represents a robust CAGR of 6.06% for the forecast period. This growth is driven by the increasing demand for various types of socks and the increasing awareness of consumers about the comfort and functionality of socks. Also, the growing popularity of casual and athletic wear has led to a greater variety of socks to suit the tastes and preferences of different consumers. Also, technological developments in the area of materials and manufacturing processes have contributed to the growth of the market. With the introduction of moisture-wicking fabrics, anti-microbial treatments, and sustainable materials, the performance and appeal of socks have improved. The leading players in the market, such as Nike, Inc., and Hanesbrands, Inc., are investing heavily in research and development to launch new products that meet the evolving needs of consumers. These companies are also focusing on strategic collaborations with fashion brands and influencers to increase their market presence and remain competitive in the dynamic market.

Regional Market Size

Regional Deep Dive

The Socks Market is experiencing dynamic growth across various regions, owing to changing consumer preferences, fashion trends, and the growing importance of comfort and functionality in the footwear. In North America, the market is characterized by strong demand for performance socks, especially among athletes and outdoor enthusiasts. In Europe, the market is characterized by a combination of traditional handicrafts and modern designs. The Asia-Pacific region is experiencing strong growth due to the growing middle class and rising disposable incomes. The Middle East and Africa are experiencing a shift towards more fashionable and fashionable socks, which are influenced by the growing urban population and lifestyle changes. Latin America is experiencing strong growth in the area of sustainable and eco-friendly socks, as consumers are increasingly becoming aware of the environment.

Europe

- The European market is seeing a resurgence in interest for luxury and designer socks, with brands like Happy Socks and Falke capitalizing on the trend for unique and colorful designs.

- Regulatory changes in the EU regarding textile sustainability are pushing manufacturers to adopt more environmentally friendly practices, impacting production methods and materials used in sock manufacturing.

Asia Pacific

- The rapid urbanization and increasing fashion consciousness in countries like China and India are driving demand for stylish and affordable socks, with local brands emerging to cater to these preferences.

- Innovations in technology, such as moisture-wicking and antimicrobial fabrics, are becoming popular, with companies like PUMA and Li-Ning investing in R&D to enhance product performance.

Latin America

- The demand for sustainable and ethically produced socks is on the rise, with brands like EcoSocks gaining popularity for their commitment to environmental responsibility.

- Local artisans are increasingly entering the market, offering handmade socks that reflect cultural heritage and traditional craftsmanship, appealing to both local and international consumers.

North America

- The rise of athleisure has significantly influenced the socks market, with brands like Nike and Adidas launching innovative performance socks designed for both sports and casual wear.

- Sustainability is becoming a key focus, with companies such as Bombas and Conscious Step leading the way in producing eco-friendly socks made from recycled materials.

Middle East And Africa

- The growing trend of online shopping in the Middle East is reshaping the socks market, with e-commerce platforms like Souq.com and Jumia offering a wide range of options to consumers.

- Cultural factors, such as the increasing acceptance of casual wear in professional settings, are leading to a rise in demand for fashionable socks that complement business attire.

Did You Know?

“In the United States alone, approximately 60% of consumers own more than 20 pairs of socks, highlighting the importance of variety and choice in this market.” — National Retail Federation

Segmental Market Size

The sock market is a dynamic sub-sector of the clothing industry, currently growing steadily, driven by changes in consumer preferences and lifestyles. There is a growing focus on comfort and functionality, especially in the athleisure segment, as well as an increased interest in sustainable materials as consumers become more conscious of their environmental impact. Also, the growing trend for personalization in fashion is influencing the design of socks, resulting in a wide variety of offerings for individual tastes. This is a mature market, with well-established players such as Nike and Adidas leading the way with their innovation and the use of advanced materials and technologies. The main end-uses are athletic performance, casual wear, and medical socks, such as compression socks. As a result of macro-economic factors such as the Cov-19 pandemic, the shift towards comfortable homewear is accelerating, further increasing demand. The development of new materials and processes such as seamless knits and moisture-wicking fabrics are enhancing the performance and the comfort of socks.

Future Outlook

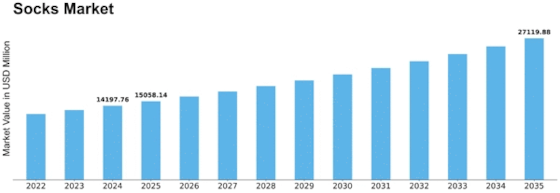

In the next ten years, the sock market is expected to rise from around 13 billion to 20 billion, with a CAGR of 6.06 per cent. The growth of the market is driven by the growing demand for various types of socks, such as sports, casual and special socks, and the growing demand for comfort and convenience in the daily wear. Moreover, as the consumption structure changes, the penetration rate of socks will increase rapidly. By 2030, the proportion of consumers who purchase new socks will rise from the current 60 per cent to 75 per cent. In the next ten years, the key development trend of the sock market will be the integration of smart fabrics and the use of green materials. The moisture-wicking and anti-odor technology has been developed. The socks will be more popular among health-conscious consumers. The development of green materials will be closely related to the trend of consumers' demand for environmentally friendly products. The sock industry will also be driven by the trend of e-commerce.

Leave a Comment