- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

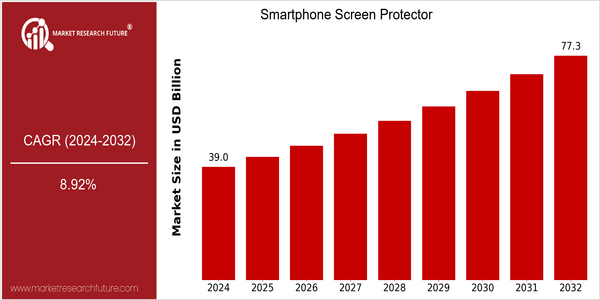

| Year | Value |

|---|---|

| 2024 | USD 39.03 Billion |

| 2032 | USD 77.3 Billion |

| CAGR (2024-2032) | 8.92 % |

Note – Market size depicts the revenue generated over the financial year

The global smartphone screen protector market is poised for significant growth, with a current market size of USD 39.03 billion in 2024, projected to reach USD 77.3 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 8.92% over the forecast period. The increasing reliance on smartphones for daily activities, coupled with the rising costs of device repairs, is driving consumers towards protective solutions, thereby expanding the market. Technological advancements in materials, such as the development of tempered glass and flexible polymer films, are enhancing the durability and effectiveness of screen protectors, further propelling market demand. Additionally, the growing trend of customization and personalization in smartphone accessories is encouraging manufacturers to innovate and diversify their product offerings. Key players in the industry, including ZAGG Inc., Belkin International, and OtterBox, are actively engaging in strategic initiatives such as partnerships and product launches to capture a larger market share and meet evolving consumer preferences.

Regional Market Size

Regional Deep Dive

The Smartphone Screen Protector Market is experiencing dynamic growth across various regions, driven by increasing smartphone penetration, rising consumer awareness about device protection, and advancements in screen protection technologies. Each region exhibits unique characteristics influenced by cultural preferences, economic conditions, and regulatory frameworks. For instance, North America showcases a strong demand for premium protective solutions, while Asia-Pacific is characterized by rapid technological adoption and a burgeoning middle class. Overall, the market is poised for significant expansion as consumers prioritize device longevity and protection.

Europe

- The European market is witnessing a shift towards eco-friendly screen protector options, with companies like PanzerGlass leading the way by offering products made from sustainable materials, aligning with the region's strong environmental regulations.

- Regulatory changes in the EU regarding product safety and consumer rights are prompting manufacturers to enhance the quality and transparency of their screen protector offerings, thereby increasing consumer trust.

Asia Pacific

- The rapid growth of the smartphone market in Asia-Pacific, particularly in countries like India and China, is driving demand for affordable yet effective screen protectors, with local manufacturers like Spigen gaining market share.

- Innovations in manufacturing processes, such as the use of tempered glass and advanced adhesive technologies, are being adopted by companies like Nillkin, enhancing product durability and performance.

Latin America

- The Latin American market is seeing a rise in local manufacturing of smartphone accessories, including screen protectors, driven by companies like Multilaser, which are focusing on affordability and accessibility.

- Economic factors, such as fluctuating currency values, are impacting consumer purchasing power, leading to a growing demand for budget-friendly screen protector options.

North America

- The rise of e-commerce platforms has significantly influenced the distribution of smartphone screen protectors, with companies like ZAGG and OtterBox expanding their online presence to cater to consumer preferences for convenience and variety.

- Recent innovations in materials, such as the introduction of self-healing screen protectors by companies like Tech21, are reshaping consumer expectations and driving demand for advanced protective solutions.

Middle East And Africa

- In the Middle East, the increasing adoption of high-end smartphones is leading to a surge in demand for premium screen protectors, with brands like BodyGuardz capitalizing on this trend.

- Cultural factors, such as the emphasis on luxury and status, are influencing consumer preferences for high-quality screen protectors, prompting companies to market premium products that align with these values.

Did You Know?

“Did you know that the global smartphone screen protector market is expected to see a significant increase in demand for anti-blue light screen protectors, as consumers become more aware of the potential eye strain caused by prolonged screen exposure?” — Market research reports and consumer surveys

Segmental Market Size

The Smartphone Screen Protector Market is currently experiencing stable growth, driven by increasing consumer awareness regarding device protection and the rising cost of smartphones. Key factors fueling demand include the proliferation of high-end smartphones with fragile screens and the growing trend of personalization, where consumers seek unique designs and features in screen protectors. Additionally, advancements in materials, such as tempered glass and flexible polymers, enhance durability and appeal to tech-savvy users. Currently, the market is in a mature adoption stage, with companies like ZAGG and Belkin leading in product innovation and distribution. Notable regions include North America and Asia-Pacific, where smartphone penetration is high. Primary applications of screen protectors extend beyond personal devices to commercial settings, such as retail and corporate environments, where device longevity is crucial. Trends such as sustainability initiatives are also catalyzing growth, as manufacturers explore eco-friendly materials. Technologies like anti-blue light coatings and self-healing materials are shaping the segment's evolution, offering consumers enhanced protection and functionality.

Future Outlook

The smartphone screen protector market is poised for significant growth from 2024 to 2032, with a projected market value increase from $39.03 billion to $77.3 billion, reflecting a robust compound annual growth rate (CAGR) of 8.92%. This growth trajectory is driven by the increasing penetration of smartphones globally, which is expected to reach approximately 80% of the global population by 2032. As consumers become more aware of the importance of device protection, the adoption of screen protectors is anticipated to rise, with usage rates potentially exceeding 60% among smartphone users by the end of the forecast period. Key technological advancements, such as the development of ultra-thin, flexible materials and self-healing technologies, are expected to enhance product offerings and attract a broader consumer base. Additionally, the growing trend of premium smartphone models, which often come with higher repair costs, will further incentivize users to invest in high-quality screen protectors. Furthermore, sustainability initiatives and eco-friendly materials are likely to gain traction, aligning with consumer preferences for environmentally responsible products. As these trends converge, the smartphone screen protector market is set to evolve, presenting lucrative opportunities for manufacturers and retailers alike.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 32.1 Billion |

| Market Size Value In 2023 | USD 35.4 Billion |

| Growth Rate | 10.25% (2023-2032) |

Smartphone screen protector Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.