Emergence of 5G Technology

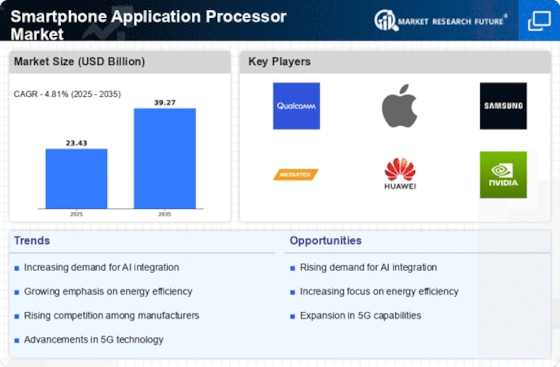

The advent of 5G technology is a pivotal driver for the Smartphone Application Processor Market. With the rollout of 5G networks, there is an increasing need for processors that can support higher data speeds and lower latency. This technological advancement is expected to enhance mobile experiences, enabling seamless streaming, gaming, and real-time applications. As a result, manufacturers are focusing on developing application processors that are optimized for 5G connectivity. The market is anticipated to witness a significant increase in demand for 5G-compatible processors, which could account for a substantial portion of the overall market by 2026. This shift not only influences the design and architecture of processors but also encourages collaboration between telecom and semiconductor companies, further stimulating growth in the Smartphone Application Processor Market.

Focus on Energy Efficiency

Energy efficiency is becoming a critical focus within the Smartphone Application Processor Market. As consumers become more environmentally conscious, there is a growing demand for processors that consume less power while delivering high performance. Manufacturers are responding by designing application processors that utilize advanced fabrication technologies and architectures to minimize energy consumption. This trend is expected to drive innovation, with many companies aiming to achieve significant reductions in power usage without compromising performance. The market for energy-efficient processors is projected to expand, with estimates indicating a potential growth rate of around 10% annually. This shift not only benefits consumers through longer battery life but also aligns with broader sustainability goals, making energy efficiency a key driver in the Smartphone Application Processor Market.

Increasing Adoption of IoT Devices

The increasing adoption of Internet of Things (IoT) devices is influencing the Smartphone Application Processor Market. As more devices become interconnected, there is a rising demand for application processors that can support various IoT functionalities. This trend is leading to the development of processors that are not only powerful but also capable of handling multiple tasks simultaneously. The market for application processors designed for IoT applications is expected to grow significantly, with projections suggesting a compound annual growth rate of around 12% over the next few years. This growth is indicative of the expanding ecosystem of smart devices, which requires robust processing capabilities. Consequently, manufacturers are focusing on creating versatile application processors that can cater to both smartphone and IoT markets, thereby enhancing the overall Smartphone Application Processor Market.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) capabilities into smartphones is transforming the Smartphone Application Processor Market. AI-driven features, such as voice recognition, image processing, and personalized user experiences, are becoming standard expectations among consumers. This trend is prompting manufacturers to develop processors that can efficiently handle AI workloads. The market for AI-enabled application processors is projected to grow significantly, with estimates suggesting a potential increase of over 15% in the next few years. This growth is indicative of the rising importance of AI in enhancing smartphone functionalities. As a result, companies are investing in specialized AI processing units within their application processors, which not only improves performance but also optimizes energy consumption. This evolution is likely to redefine the competitive landscape of the Smartphone Application Processor Market.

Rising Demand for High-Performance Devices

The Smartphone Application Processor Market is experiencing a surge in demand for high-performance devices. As consumers increasingly seek smartphones that can handle demanding applications, gaming, and multitasking, manufacturers are compelled to innovate. The market for application processors is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is driven by the need for enhanced processing power and efficiency, which are critical for delivering superior user experiences. Consequently, companies are investing heavily in research and development to create processors that can support advanced functionalities, such as augmented reality and artificial intelligence. This trend indicates a shift towards more powerful and capable smartphones, thereby propelling the Smartphone Application Processor Market forward.