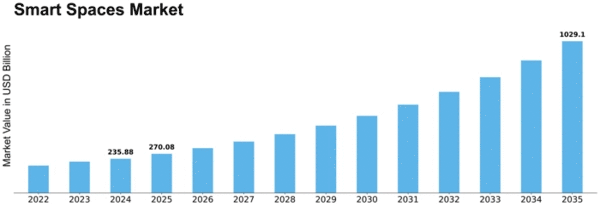

Smart Spaces Size

Smart Spaces Market Growth Projections and Opportunities

A confluence of technological advancements, changing consumer behaviors, and increasing integration of smart technologies across different industries shape the market dynamics of Smart Spaces. Smart Spaces refer to environments enhanced with interconnecting devices, and intelligent systems have seen a remarkable rise in demand recently. The healthcare sector is undergoing a revolutionized patient care and operational efficiency through the adoption of Smart Spaces. To this end, smart hospitals utilize interconnected devices to facilitate the real-time monitoring of patients, automate routine tasks, and enhance communication among healthcare professionals. This not only improves the overall quality of care but also optimizes resource allocation. On the other hand, in the retailing industry, Smart Spaces have completely revolutionized customer experience. Retailers are using IoT-enabled devices to collect and analyze data about customers that enable personalized shopping experiences, optimize inventory management, and streamline supply chains. Similarly, the transportation industry is going through a paradigm shift due to Smart Spaces. In particular, the use of IoT enhances traffic management systems for intelligent transportation, improving vehicle safety measures while optimizing public transportation services. Additionally, there is increased use of smart technologies in urban planning, which has led to the development of smart cities where interconnected systems efficiently manage resources such as energy consumption and public services. The evolution of artificial intelligence (AI) and machine learning (ML) also shapes the market dynamics for Smart Spaces. These technologies enable smart systems to learn and adapt, thereby enhancing their capability to analyze data so that they can make better decisions or predictions based on information available to them. AI and ML contribute towards predictive analytics within Smart Spaces, thus enabling proactive maintenance strategies, energy optimization measures, and personalized user experiences. Consumer preferences and expectations are key determinants for market dynamics within Smart Spaces as well. With increasing consumer awareness of technological issues, there is an emerging need for seamless connectivity alongside automation capabilities at home or workplaces as well as beyond these boundaries. The increase in popularity of smart home devices such as thermostats, lighting systems, and security cameras is an example. However, the Smart Spaces market faces challenges as well, along with opportunities that affect its dynamics. For instance, there is a concern about security, especially in relation to data privacy and system reliability, since interconnected devices can be highly vulnerable to cyber-attacks. Another challenge is posed by interoperability issues between different smart devices and systems that hinder their seamless integration. In order to address such challenges and stimulate continued growth of the Smart Spaces market, standardization efforts and advances in cybersecurity are required.

Leave a Comment