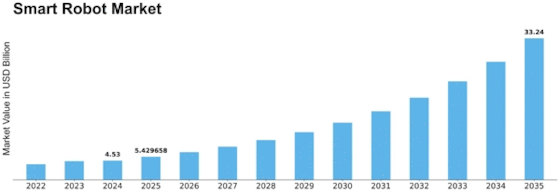

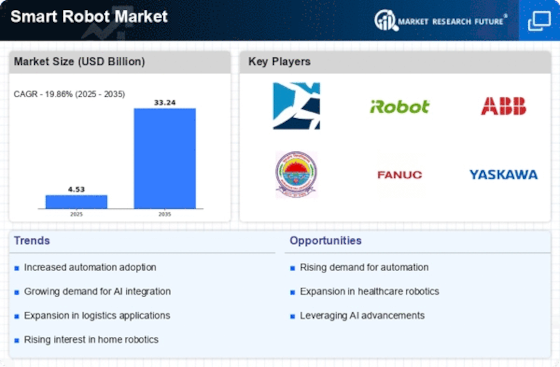

Smart Robot Size

Smart Robot Market Growth Projections and Opportunities

The dynamics and expansion of the smart robot market are influenced by many market variables, which also shape the industry's trajectory across different industries. The growing need for automation in industries including manufacturing, healthcare, logistics, and consumer services is one important cause. The use of intelligent robots becomes strategically necessary as companies want to increase output, save expenses, and improve efficiency. Intelligent robots' capacity to work independently, manage repetitive activities, and function in many settings makes them an invaluable resource for enterprises trying to maintain their competitiveness in a business climate that is changing quickly. The development of technology is another important market element propelling the rise of smart robots. The sophistication is increased by the ongoing advancements in sensing, machine learning, and artificial intelligence (AI). These robots are equipped with sophisticated AI algorithms that enable them to sense and adjust to their environment, increasing their capacity to perform intricate jobs precisely. The incorporation of state-of-the-art technology augments the overall performance of intelligent robots, rendering them more attractive to sectors seeking inventive approaches to meet their particular requirements. Return on investment (ROI) and cost-effectiveness factors are other significant factors that influence the smart robot industry. Businesses are starting to realize that investing in smart robots may pay off in the long run by boosting productivity and reducing costs associated with maintenance. Smart robots are becoming more and more appealing due to their potential for reduced labor costs, increased accuracy, and greater operational efficiency. The ROI for smart robot adoption increases for a wider variety of businesses as the cost of robotic components declines and technology breakthroughs drive efficiency benefits. The geopolitical and global economic landscapes are examples of external market dynamics influencing the smart robot industry. Growth and stability in the economy encourage more investments in automation technology, although geopolitical developments can impact supply chain dynamics and market dynamics. Standards and regulations can have a significant impact on how the market is shaped. Concerns about privacy, security, and the effects of automation on the workforce are being addressed by governments and international organizations as they create rules for the safe and moral application of smart robots.

Leave a Comment