Market Share

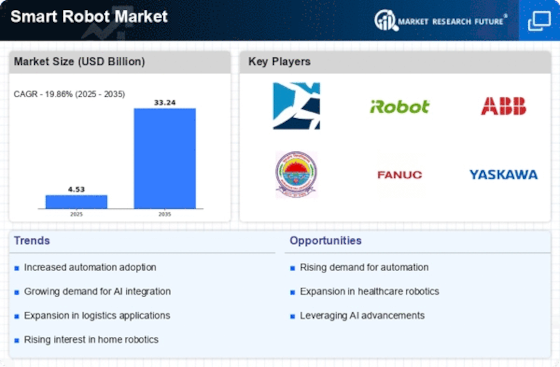

Smart Robot Market Share Analysis

Companies use a variety of market share positioning techniques to create a strong presence and obtain a competitive edge in the highly competitive smart robot industry. Differentiation is a common approach, where businesses concentrate on providing special features and capabilities that distinguish their intelligent robots from rival models. Through research and development expenditures, businesses might provide cutting-edge technology, sophisticated sensors, or improved artificial intelligence capabilities, generating a unique value proposition that caters to certain market demands or consumer inclinations. Cost leadership is another important tactic, where businesses want to dominate the market by providing intelligent robots at a reduced price without sacrificing quality. This strategy frequently entails reaching economies of scale, effectively obtaining commodities, and streamlining production processes. Economical solutions establish firms as leaders in value and affordability by opening up smart robotics to a wider variety of sectors and enterprises. One tactic is market segmentation, which entails designing intelligent robots for certain applications or industrial verticals. Robots with characteristics and capabilities tailored for the industrial, healthcare, logistics, or other industries may be designed by companies. By focusing on specific issues, businesses are able to meet the distinctive demands and difficulties of each sector and establish themselves as subject matter experts in their fields. In the market for smart robots, cooperation, and strategic alliances are becoming more and more popular approaches. To take advantage of complementary capabilities, businesses might join forces with system integrators, technology suppliers, or industry leaders. By working together, businesses may develop integrated solutions that bring together the knowledge of several different organizations, offering complete smart robot systems that satisfy a range of client demands. Companies may reach new client groups and broaden their market reach with the aid of these strategic alliances. Manufacturers of smart robots use geographic expansion as a tactic to reach new markets and broaden their worldwide presence. To get a bigger share, businesses can concentrate on expanding into developing areas where automation is becoming more and more necessary, or they might forge a strong presence in developed markets. Using this approach, businesses may customize their smart robots to succeed in certain locations by taking into account local differences in client demands, legal requirements, and cultural preferences.

Leave a Comment