Smart Packaging Size

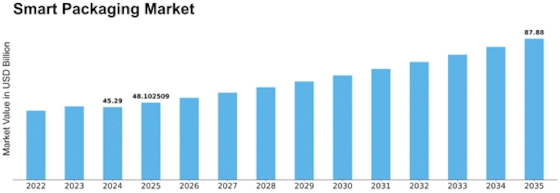

Smart Packaging Market Growth Projections and Opportunities

The smart packaging market is influenced by various factors that shape its dynamics and determine its performance. Smart packaging, also known as intelligent packaging, incorporates sensors, RFID tags, and other advanced technologies to provide functionalities such as tracking, monitoring, and communicating information about the packaged product. One of the primary market factors impacting the global smart packaging market is the increasing demand for product traceability and safety. With consumers becoming more concerned about the origin, quality, and authenticity of products, there is a growing need for packaging solutions that can track and trace products throughout the supply chain. Smart packaging addresses this demand by enabling real-time monitoring of product location, condition, and authenticity, driving its adoption in various industries such as food and beverages, pharmaceuticals, and cosmetics.

More and more companies in the global smart packaging industry are incorporating freshness indicators, indicators of germ and pathogen growth, devices that can sense the buildup of gas (a great indicator of microbial growth), and time-temperature indicators in their packaging. This is projected to be a major driver of smart packaging market growth.

Moreover, technological advancements and innovations significantly influence the global smart packaging market. Manufacturers are constantly innovating to develop smart packaging solutions with improved performance, functionality, and cost-effectiveness. For example, advancements in sensor technologies, such as printed sensors and NFC tags, enable manufacturers to incorporate intelligent features into packaging without significantly increasing production costs. Additionally, innovations in communication technologies, such as IoT-enabled packaging systems, facilitate seamless data exchange between packaging and connected devices, improving supply chain visibility and efficiency.

Furthermore, regulatory factors play a crucial role in shaping the global smart packaging market. Regulations and standards related to product safety, labeling, and environmental sustainability drive the adoption of smart packaging solutions that comply with regulatory requirements. For example, regulations governing food safety, such as the Food Safety Modernization Act (FSMA) in the United States, mandate the use of packaging materials and technologies that ensure the safety and integrity of food products. Similarly, regulations related to pharmaceutical packaging, such as the Serialization and Traceability Regulation in Europe, require pharmaceutical manufacturers to implement track-and-trace systems for product authentication and anti-counterfeiting purposes. Compliance with regulatory requirements is essential for smart packaging manufacturers to access key markets and maintain customer trust.

Market dynamics such as supply chain considerations and technological advancements also impact the global smart packaging market. The smart packaging supply chain involves multiple stages, including the sourcing of raw materials, manufacturing of packaging components, integration of smart features, and distribution to end-users. Disruptions at any stage of the supply chain, such as raw material shortages, technological limitations, or regulatory challenges, can affect the availability and pricing of smart packaging solutions. Additionally, advancements in smart packaging technologies, such as flexible and printable electronics, enable manufacturers to develop innovative packaging solutions that meet the evolving needs of different industries and applications.

Moreover, market factors such as globalization and trade policies influence the global smart packaging market. As smart packaging manufacturers expand their operations to new markets and regions, there is a growing demand for packaging solutions that comply with local regulatory requirements and cultural preferences. Additionally, trade policies, tariffs, and international agreements related to packaging materials and technologies can impact the competitiveness of smart packaging manufacturers in global markets, affecting market dynamics and pricing. Understanding these market factors and adapting manufacturing and distribution strategies accordingly is essential for smart packaging manufacturers to remain competitive in the dynamic and evolving global market.

Leave a Comment