Market Trends

Key Emerging Trends in the Smart Grid Networking Market

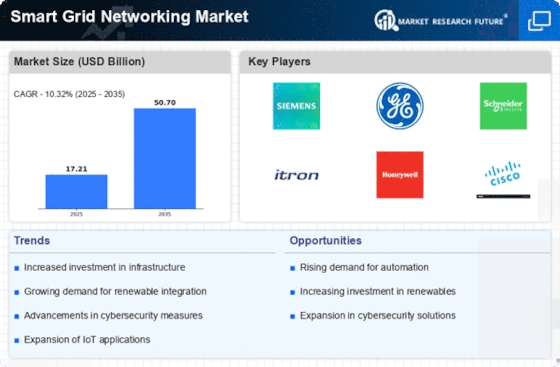

Powerful trends in the Smart Grid Networking market are shaping the power industry's landscape. Market patterns in Smart Grid Networking reveal a key driver: integration of advanced technological innovations. One emerging trend in the Smart Grid Networking market is an increasing emphasis on network security. In addition to this, there has been an increase in digital threats due to a larger number of devices connected to smart grids. Consequently, much attention has shifted towards putting up robust cyber-security measures for safeguarding critical infrastructure. Market players are heavily investing in the development of sophisticated online protection solutions that would protect smart grid networks from possible cyber-attacks, thereby maintaining integrity and reliability throughout the entire energy system. Interoperability is influencing another big trend occurring within the Smart Grid Networking market space. Integration and communication between various components and devices need seamless integration with each other due to the expansion of the smart grid domain environment. Additionally, innovation in smart grid networking is mainly driven by its integration with renewable sources of energy production. The growing share of solar and wind power generation requires smart grid solutions capable of effectively handling irregularity and variability associated with such renewable sources. Continuous monitoring, control, management, and re-optimization through smart grid networking may allow easier inclusion of renewable power into the grid as well. This aligns with global efforts towards sustainable and clean energy options. In fact, data analytics alongside AI is gaining importance within the Smart Grid Networking market. The large amounts of data generated by smart grid devices provide valuable insights that can be harnessed for better autonomous guidance and predictive maintenance. Investments in Smart Grid Networking solutions are growing as governments all over the world focus on energy efficiency and grid modernization. Advanced metering infrastructure (AMI) alongside smart meters is being installed across many countries, enabling utilities to collect real-time information about energy consumption. This, together with analytics, empowers both consumer and utility firms to make informed choices, streamline their energy use, and contribute to a more sustainable, resilient power system.

Leave a Comment