Market Trends

Key Emerging Trends in the Smart Doorbell Market

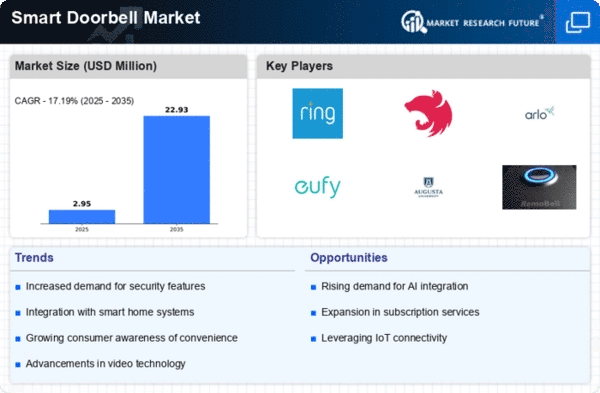

The market for smart doorbells is showing a lot of new trends that show how people's wants and needs are changing. The need for more improved protection features is one example of this. As people become more worried about home security, they are moving toward smart doorbells that offer more than just basic video tracking. With features like AI-driven danger detection, customizable motion zones, and face recognition, which are becoming more common, homeowners can now make their security systems fit their specific needs and situations. Different parts of smart homes are connecting with each other more and more. Consumers want their smart doorbells and other smart home tech to easily connect and work together. Users can control their doorbells with their mouths when they use virtual assistants like Google Assistant and Amazon Alexa. This makes the smart home experience better overall. Video data is also growing, which has an effect on the market for smart doorbells. Newer smart doorbells have more advanced video analytics features, like the ability to analyze behavior and identify objects. This makes it possible for more advanced tracking and warning features to be added, such as the ability to tell the difference between people, animals, and packages. With the continued growth of these data technologies, smart doorbells should be able to offer more advanced and useful features to homes. It's becoming more and more popular for smart doorbells to look sleek and not get in the way. Manufacturers are reacting to homeowners' growing awareness of how smart devices look in their homes by making products that look good with a wide range of building styles. With thinner shapes, customizable faceplates, and simple designs, smart doorbells can now fit in with the look of a wider range of houses. The low cost of smart alarm technology is another important trend. Smart doorbell prices keep going down as the market grows and more companies enter it. Higher usage rates have come about because of this trend. This means that more people can use those products. One way to get more people to use smart houses and grow the market beyond early adopters is to make them cheaper. Over-the-air (OTA) software updates and changes have become very popular. Growing numbers of companies are realizing how important it is to keep their goods up to date with the latest security changes, features, and improvements. Keeping the software for smart doorbells up to date not only makes them work better and safer, but it also makes them last longer.

Leave a Comment