Top Industry Leaders in the Smart Commute Market

Competitive Landscape of the Smart Commute Market: A Landscape in Motion

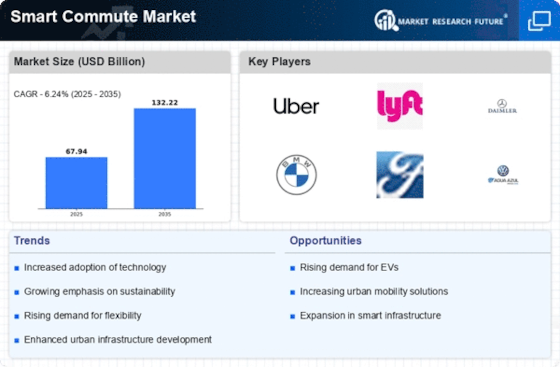

The smart commute market, encompassing technologies and services optimizing daily commutes, is experiencing dynamic growth fueled by urbanization, environmental concerns, and advancements in mobility tech. This burgeoning market fosters diverse competition, with established players, nimble startups, and even public transportation authorities vying for dominance.

Key Players:

- South Florida Commuter Services (US)

- ePoolers Technologies Pvt. Ltd. (India)

- Quick Ride (India)

- Uber Technologies Inc. (India)

- ANI Technologies Pvt. Ltd.(India)

- Metrolinx (Canada

- ZipGo Technologies Pvt. Ltd (India)

- Central Indiana Regional Transportation Authority (CIRTA) (US)

- Oakland Smart Commute (California)

- CommuteSMART (US)

- BlaBlaCar (France)

- Turo (US)

- Carma Technology Corporation (Europe)

Factors for Market Share Analysis:

-

Geographical Reach: Companies with larger regional networks and user bases hold an advantage in ride-sharing and carpooling segments. -

Technological Innovation: Continuous development of AI-powered route optimization, real-time data integration, and seamless multi-modal travel planning tools is crucial for differentiation. -

Public-Private Partnerships: Collaboration with transit authorities and city governments can facilitate infrastructure access, data sharing, and program integration, boosting market penetration. -

Sustainability Focus: Offering carbon-neutral options like e-bikes and carpooling, and demonstrating environmental consciousness, resonates with eco-conscious consumers and businesses. -

Corporate Social Responsibility: Companies engaging in employee commute benefit programs and promoting healthy, active commutes gain favor with environmentally and socially responsible businesses.

New and Emerging Players:

-

AI-driven Commuter Optimization Startups: Companies like Remix and Optibus leverage AI to create dynamic, real-time traffic management systems and optimize public transportation routes, targeting cities and transit authorities. -

MaaS (Mobility as a Service) Providers: Startups like Whim and MaaSify aim to offer subscription-based access to a variety of transportation options, including public transit, carpooling, and micromobility, through a single platform, challenging traditional ownership models. -

Smart Parking Solutions: Companies like ParkWhiz and SpotHero provide real-time parking availability information and booking capabilities, integrating seamlessly into commute planning apps and reducing driving frustration.

Current Investment Trends:

-

Venture Capital: Investors are increasingly interested in innovative commute solutions, particularly in micromobility, AI-powered optimization, and MaaS platforms, recognizing their potential to disrupt traditional transportation models. -

Public Funding: Governments are investing in smart infrastructure, real-time data sharing initiatives, and pilot programs testing new commute technologies, fostering market growth and collaboration. -

Corporate Partnerships: Businesses are partnering with commute solution providers to offer employee commute benefits, improve employee well-being, and reduce carbon footprint, creating a lucrative B2B market segment.

Conclusion:

-

Motivate AI secures $40 million: The AI-powered commute optimization platform announced its Series B funding on Jan 10, 2024, to expand its reach and integrate with public transit systems. -

Micromobility startup Beam raises $100 million: Beam, a provider of shared e-scooters and e-bikes, secured funding on Jan 17, 2024, to launch in new cities and develop next-generation micromobility solutions. -

Ford partners with Waze for real-time traffic data: Ford and Waze announced a partnership on Jan 9, 2024, to integrate Waze's real-time traffic data into Ford's in-vehicle navigation systems, improving commute efficiency.