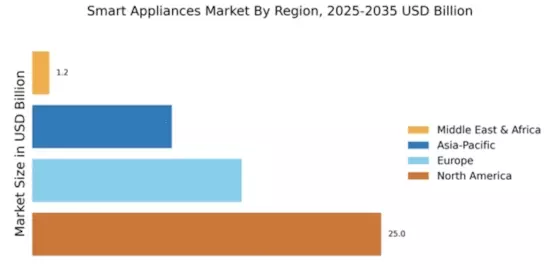

North America : Market Leader in Smart Appliances

North America is poised to maintain its leadership in the Smart Appliances Market, holding a significant market share of 25.0 in 2024. The growth is driven by increasing consumer demand for energy-efficient and connected devices, alongside supportive regulations promoting smart technology adoption. The region's focus on sustainability and innovation further fuels market expansion, with smart appliances becoming integral to modern households. The competitive landscape is dominated by key players such as Samsung Electronics, LG Electronics, and Whirlpool Corporation, which are continuously innovating to meet consumer needs. The U.S. leads the market, supported by a robust distribution network and high consumer spending on home automation. As smart technology becomes more mainstream, the presence of established brands ensures a dynamic and competitive environment.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing interest in smart appliances, with a market size of 15.0 projected for 2025. The region's growth is driven by increasing urbanization, rising disposable incomes, and a strong emphasis on energy efficiency. Regulatory frameworks, such as the EU's Green Deal, are catalyzing the adoption of smart technologies, making them more appealing to consumers seeking sustainable solutions. Leading countries in this market include Germany, France, and the UK, where major players like Bosch and Miele are innovating to capture market share. The competitive landscape is characterized by a mix of established brands and emerging startups, all vying for consumer attention. As smart appliances become more integrated into daily life, the European market is set for significant growth, driven by both consumer demand and regulatory support.

Asia-Pacific : Rapid Growth in Smart Technology

The Asia-Pacific region is experiencing rapid growth in the Smart Appliances Market, with a market size of 10.0 anticipated by 2025. This growth is fueled by rising urbanization, increasing disposable incomes, and a growing preference for smart home technologies. Countries like China and Japan are at the forefront, with government initiatives promoting smart technology adoption and energy efficiency, creating a favorable environment for market expansion. China, as a manufacturing powerhouse, hosts major players like Haier and Panasonic, which are leading the charge in innovation and product development. The competitive landscape is vibrant, with both local and international brands competing for market share. As consumer awareness of smart appliances increases, the region is set to become a significant player in the global market, driven by technological advancements and changing consumer preferences.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the Smart Appliances Market, with a market size of 1.22 projected for 2025. The growth is primarily driven by increasing urbanization, a young population, and rising disposable incomes. However, the market remains largely untapped, with significant opportunities for growth as consumers become more aware of smart technologies and their benefits. Countries like South Africa and the UAE are leading the way in adopting smart appliances, supported by government initiatives aimed at enhancing energy efficiency. The competitive landscape is still developing, with both local and international brands exploring opportunities. As infrastructure improves and consumer awareness grows, the region is expected to see a surge in demand for smart appliances, paving the way for future market expansion.