Market Trends

Key Emerging Trends in the Small UAV Market

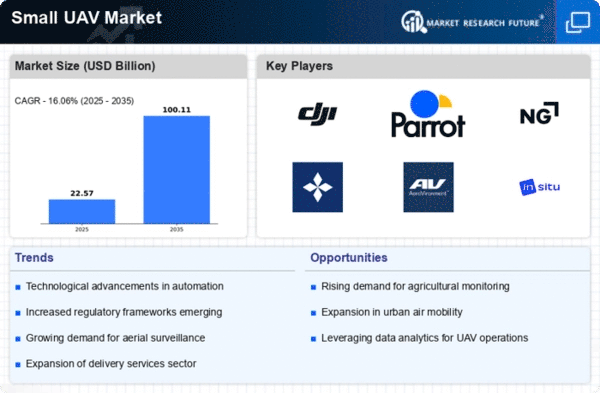

The small Unmanned Aerial Vehicle (UAV) market has witnessed significant growth in recent years, fueled by advancements in technology, increasing demand for surveillance and reconnaissance applications, and a growing emphasis on commercial applications. The popular UAVs which are compact in size and diverse in purpose have been deployed across multiple sectors such as agriculture, construction, public safety, and entertainment. Among the most important market trends that the small UAVs sector is incorporating cutting-edge technology. Manufacturers are continue to add advanced features like AI, machine learning and the advancement of sensors so the small UAV can operate more efficiently. These technological inventions make the drones even perform better and widen the uses of drones. For example, AI-integrated drones can be used to do missions such as a search and rescue operations or infrastructure inspection by a way of completely autonomous navigation of complex environment. The demand for civil and commercial usage is the critical factor leading to the global growth in the Small Unmanned Aerial Vehicle (UAV) market. The fast growing trends in technology together with cheaper rates of acquisition and the cost-effectiveness of their operations have contributed to the remarkable development of the market for commercial small UAVs. The applications of such UAVs covers a wide range of activities, among which are surveying, aerial photography, pipelines patrol, 3D mapping, turbine blades inspection, as well as numerous similar functions. Moreover, the market in the Asian and Pacific, South America, and Middle East regions has also seen a rapid growth which revealed a greater potential in the use of UAVs, primarily in military applications, and consequently fueling the market’s growth. There is another big trend that you should look at is the number of small unmanned aerial vehicles that are being used in agriculture. Farmers are employing drones in farming to trim, assess, and optimize use of resources. Moreover, the small UAVs market experiences an increase in itss demand from the building industry as well. Drones have seen the service as site surveys, progress monitoring, and infrastructure inspection. The capability of the small UAVs to capture hyper-resolution images and create precise 3D models allows for more accurate and timely project management and cuts down the time and cost of the traditional survey methods. More important aspects of this area are the growing interests of the public safety agencies that use these devices in their services. Police, firefighters, and rescue teams are increasingly relying on drone technologies for aerial surveillance, search and rescue, and disaster response from a safe distance. The adaptability and the versatility of Small UAVs are their biggest asset in emergency situations, offering real time data and perspective for informed decision making. The commercialization of Unmanned Aerial Vehicles (UAVs) for leisure purposes and photography has likewise played a role. Still, regulatory frameworks, privacy concerns, and airspace management are the items that conjointly affect the smallest unmanned aerial vehicle market. Governments and aviation authorities are working to establish comprehensive regulations to ensure the safe and responsible use of drones. Striking the right balance between fostering innovation and addressing safety and privacy concerns is crucial for the sustained growth of the small UAV market.

Leave a Comment