Market Analysis

In-depth Analysis of Small UAV Market Industry Landscape

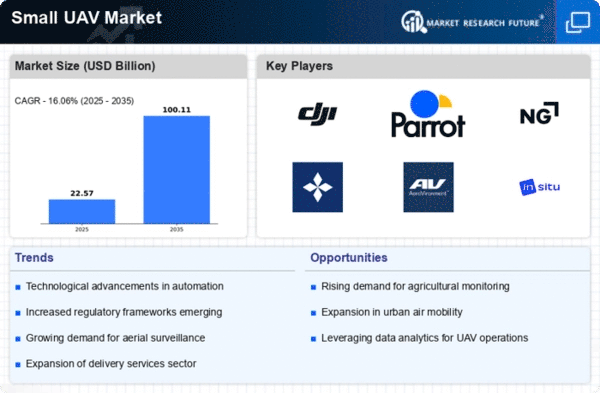

The small Unmanned Aerial Vehicle (UAV) market has experienced significant growth in recent years, driven by advancements in technology and an expanding range of applications. Market dynamics within this sector are influenced by various factors that shape its trajectory. The industry is witnessing this due to the growing need of micro UAVs in different areas such as agriculture, surveillance, mapping and delivery networks. The advantages of low cost and multi-tasking capability of these drones have brought them into practical applications that range from monitoring crops to inspection of infrastructures. Technological innovation is a driving force that fundamentally molds the market scenario of small UAVs. The sensors, cameras and communication systems among others keep evolving, hence drones can take on complicated tasks such as gathering/sending more precise data. Advanced battery technology can lengthen the flight durations of UAV, which can then cover wider areas and function for longer, thereby making their applications broader. Regulatory frameworks have a central role as determining factors in the dynamics of small UAVs market. The governments all over the world have been trying to come up with and modify rules to reflect the safety concerns and promote the reliable UAV use as well. The current of the manufacturing and operators which these regulations should be followed by is a crucial consideration that may affect the market entrance and the growth. With the emergence of regulatory settings, the industry should remain agile in terms of it’s innovation and safety. Competition in small UAV market is getting severe for both the existing players and new comers who want their market share. The competition has not resulted in a halt but quite on the contrary with new features, cost-reducing and product enhancement to end-users. The market encompasses a multitude of players – top aerospace companies that are rigid and slow to operate standing on the one end, and the startup on the other, that is agile and moves at a fast pace. These players bring to the table varied viewpoints and skills in order to drive the ecosystem. The report's scope covers the market for the small UAV (unmanned aerial vehicle), where the main small UAV players in the market, the emerging suppliers in the small UAV market, numerous applications of small UAVs, and the predicted rate of small UAV demand in the subsequent years, are the main places of interest. Economic global trends are also among the many factors that have an impact on the small drone market dynamics. Increasing economic development in emerging markets often results in the increased demand for UAVs, their region targeting the solutions for issues including optimization of agriculture or construction of necessary infrastructure. While economic downturns may reduce investment in technology but it does not discourage the adoption of small UAVs in many industries. There are more and more joint ventures and strategic alliances in the earthbound UAVs market now, as companies are looking forward to seizing the most out of their partners’ strengths and get better results. The influence and sustainability aspects of small UAVs cannot be ignored in the market dynamics.As awareness of the environmental impact of traditional aviation grows, there is a growing interest in electric-powered and environmentally friendly UAVs. This shift towards sustainability aligns with broader global initiatives to reduce carbon footprints and promote responsible technology adoption.

Leave a Comment