Expansion of Biopharmaceutical Sector

The biopharmaceutical sector's expansion is significantly influencing the Small Molecule API Market. With the increasing number of biopharmaceutical companies entering the market, there is a heightened demand for small molecule APIs that serve as essential components in drug formulation. Data suggests that the biopharmaceutical market is projected to reach over 500 billion dollars by 2025, which could lead to a corresponding increase in the demand for small molecule APIs. This growth is driven by the need for innovative therapies that address unmet medical needs. As biopharmaceutical companies continue to explore novel drug candidates, the Small Molecule API Market is likely to experience substantial growth, driven by the integration of small molecules in therapeutic regimens.

Growing Demand for Targeted Therapies

The increasing demand for targeted therapies is emerging as a significant driver for the Small Molecule API Market. As healthcare providers and patients seek more effective treatment options, the focus on precision medicine is intensifying. Targeted therapies, which often utilize small molecules to specifically address disease mechanisms, are gaining traction in various therapeutic areas, including oncology and autoimmune diseases. Market analysis suggests that the targeted therapy segment is expected to grow substantially, potentially reaching over 100 billion dollars by 2025. This trend indicates a shift towards more personalized treatment approaches, which could lead to a higher demand for small molecule APIs that are integral to these therapies. Consequently, the Small Molecule API Market is likely to benefit from this evolving landscape.

Regulatory Support for Drug Development

Regulatory frameworks that support drug development are playing a pivotal role in shaping the Small Molecule API Market. Agencies such as the FDA and EMA have implemented streamlined processes for the approval of new drugs, which may expedite the entry of small molecule APIs into the market. The introduction of initiatives like the Breakthrough Therapy Designation and Fast Track Designation appears to encourage innovation by providing incentives for companies to develop small molecules that address serious conditions. This regulatory support is likely to enhance the attractiveness of investing in small molecule drug development, thereby fostering growth within the Small Molecule API Market. As a result, the market may witness an influx of new products that meet regulatory standards.

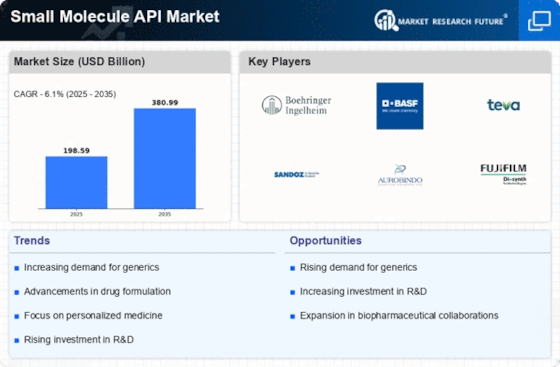

Rising Investment in Pharmaceutical R&D

Investment in pharmaceutical research and development is a crucial driver for the Small Molecule API Market. As companies seek to innovate and bring new drugs to market, the allocation of resources towards R&D has seen a marked increase. Reports indicate that global pharmaceutical R&D spending is expected to exceed 200 billion dollars by 2025. This surge in investment is likely to facilitate the discovery and development of new small molecule APIs, enhancing the therapeutic landscape. Moreover, the competitive nature of the pharmaceutical industry compels companies to focus on developing unique small molecules that can provide a competitive edge. Consequently, the Small Molecule API Market stands to gain from this trend as new products emerge from the pipeline.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cancer, and cardiovascular disorders appears to be a primary driver for the Small Molecule API Market. As healthcare systems strive to address these conditions, the demand for effective therapeutic solutions intensifies. Reports indicate that chronic diseases account for approximately 70% of all deaths worldwide, necessitating the development of innovative small molecule drugs. This trend is likely to propel pharmaceutical companies to invest in research and development, thereby expanding the small molecule API portfolio. Furthermore, the increasing focus on personalized medicine may lead to the creation of targeted therapies, further stimulating market growth. The Small Molecule API Market is thus positioned to benefit from this growing healthcare challenge.