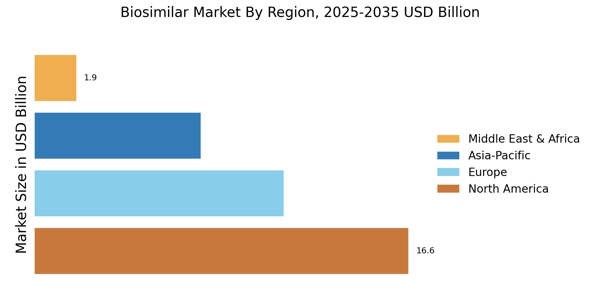

Based on the Region, the global Biosimilar are segmented into North America, Europe, Asia-Pacific, Rest of the World. The Europe dominated the global market in 2024, while the Asia-Pacific is projected to be the fastest–growing segment during the forecast period. Companies are competing for biosimilar market share by proving interchangeability through rigorous bioanalytical assays that confirm identical clinical efficacy.

Major demand factors driving the Europe market are the growing incidences of cancer and rare disorders and increasing launch of biosimilar and rising healthcare costs. The European Medicines Agency (EMA) has been at the forefront of biosimilar approvals, encouraging market penetration and physician confidence.

Additionally, the rising healthcare costs across the region have pushed governments and healthcare systems to adopt cost-effective alternatives to branded biologics, further fueling biosimilar uptake.

The presence of leading pharmaceutical companies and active initiatives to educate healthcare providers and patients have also supported market growth. Emerging markets in APAC are significantly contributing to the increasing biosimilar market size due to local manufacturing incentives and rising healthcare access. Supportive regulatory reforms and growing awareness of affordable treatment options are expected to accelerate biosimilar adoption across emerging markets like India, China, and South Korea and it has made APAC the fastest growing region.

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, Australia, South Korea, Middle East and Africa, South America and others.

Additionally, the rising healthcare costs across the region have pushed governments and healthcare systems to adopt cost-effective alternatives to branded biologics, further fueling biosimilar uptake.

The presence of leading pharmaceutical companies and active initiatives to educate healthcare providers and patients have also supported market growth. However, the Asia-Pacific region is projected to be the fastest-growing during the forecast period due to expanding healthcare infrastructure, a large patient population, and increasing investments by domestic and international biopharma companies. Supportive regulatory reforms and growing awareness of affordable treatment options are expected to accelerate biosimilar adoption across emerging markets like India, China, and South Korea.

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, Australia, South Korea, Middle East and Africa, South America and others.