Simulation Software Size

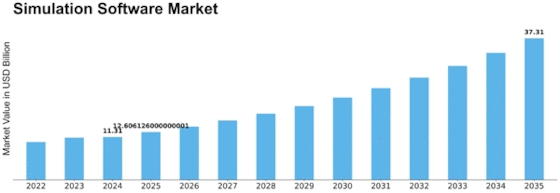

Simulation Software Market Growth Projections and Opportunities

The simulation software market is changing due to inventive advances, industry demands for efficacy, and the growing need for virtual testing and prototyping across sectors. Development of product enhancement procedures drives market components. Simulation software lets companies create virtual models, test multiple plan scenarios, and improve product performance without physical models, speeding up product development. In auto, aviation, and manufacturing, minimizing time-to-market and ensuring product quality are crucial.

The complexity of organizational frameworks and processes is also driving simulation software adoption. As products improve, traditional experimental methods become nonsensical. Simulation tools allow organizations to demonstrate multidimensional frameworks, analyze their behavior under different settings, and anticipate potential difficulties before they occur. This proactive approach reduces costly mistakes and enhances product quality and security.

Another major factor impacting the simulation software industry is Industry 4.0 and the IoT. Simulation software, IoT devices, and real-time data are essential for sophisticated projects. This partnership helps associations create more realistic simulations by including verified elements and criticism to enhance expectations. Simulation software empowers firms adopting Industry 4.0 standards by recreating IoT-driven scenarios like dazzling assembly procedures or independent car frameworks.

The growing emphasis on maintainability and ecological considerations shapes simulation software market segments. Simulation tools are being used to improve energy efficiency, assess product and cycle effects, and explore eco-friendly plans. This fits with the global focus on manageability, as companies restrict their biological impact and follow administrative rules.

The simulation software industry has established merchants and specialist companies offering unique arrangements. Sellers are investing in novel simulation software, integrating advanced features like artificial intelligence and ML for more accurate simulations. Simulation software's adaptability across industries, from medical care to research, has spurred competition and innovation, resulting in a variety of contributions tailored to industry needs.

Future development and advancement are possible in the simulation software industry. VR and AR advancements must be coordinated with simulation software to improve simulations' vividness and broaden their use in training, planning, and preparation. The democratization of simulation tools, making them more accessible to small and medium-sized businesses, may increase market acceptance.

Leave a Comment