Technological Advancements

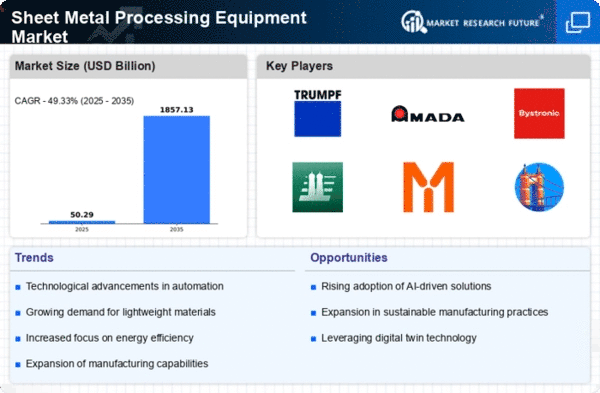

The Global Sheet Metal Processing Equipment Market Industry is experiencing a surge in technological advancements, which enhances efficiency and precision in manufacturing processes. Innovations such as laser cutting, CNC machining, and automation are transforming traditional methods. For instance, the integration of IoT in machinery allows for real-time monitoring and predictive maintenance, reducing downtime. As manufacturers adopt these technologies, productivity increases, leading to a projected market value of 136.1 USD Billion in 2024. This trend indicates a shift towards smart manufacturing, which is likely to drive growth in the industry.

Expansion of Aerospace Industry

The aerospace industry is a vital driver of the Global Sheet Metal Processing Equipment Market Industry, as it requires high-precision components and materials. With the increasing demand for air travel and advancements in aerospace technology, manufacturers are investing in sophisticated sheet metal processing equipment. This sector's growth is expected to contribute significantly to the market's expansion, with a projected value of 216.1 USD Billion by 2035. The need for lightweight and durable materials in aircraft manufacturing further emphasizes the importance of advanced processing technologies, indicating a robust future for the industry.

Growth in Construction Activities

The Global Sheet Metal Processing Equipment Market Industry is significantly influenced by the growth in construction activities worldwide. As urbanization accelerates, the demand for metal structures and components in buildings and infrastructure projects increases. This trend is particularly evident in emerging economies, where rapid development is underway. The market is projected to reach 216.1 USD Billion by 2035, driven by the need for durable and efficient materials. Consequently, manufacturers are likely to invest in advanced sheet metal processing technologies to meet the rising demand, thereby propelling the market forward.

Increased Focus on Energy Efficiency

Energy efficiency is becoming a crucial consideration in the Global Sheet Metal Processing Equipment Market Industry. Manufacturers are increasingly seeking equipment that minimizes energy consumption while maximizing output. This shift is driven by regulatory pressures and the need for sustainable practices. Equipment that incorporates energy-efficient technologies not only reduces operational costs but also aligns with global sustainability goals. As a result, the market is likely to see a rise in demand for such innovative solutions, contributing to a projected CAGR of 4.29% from 2025 to 2035, as companies strive to enhance their environmental performance.

Rising Demand from Automotive Sector

The automotive sector is a primary driver of the Global Sheet Metal Processing Equipment Market Industry, as it requires high-quality metal components for vehicle production. With the increasing production of electric vehicles and lightweight materials, the demand for advanced sheet metal processing equipment is expected to rise. In 2024, the market is valued at 136.1 USD Billion, reflecting the automotive industry's pivotal role. Furthermore, as the automotive sector aims for sustainability, manufacturers are likely to invest in more efficient processing technologies, potentially increasing the market's CAGR to 4.29% from 2025 to 2035.