Aging Population

The aging population is a notable driver of the Self-Monitoring Blood Glucose Device Market. As the global demographic shifts towards an older population, the incidence of chronic diseases, including diabetes, is on the rise. Older adults often require more frequent monitoring of their blood glucose levels, which increases the demand for self-monitoring devices. This demographic trend is prompting manufacturers to develop devices that cater specifically to the needs of elderly patients, such as simplified interfaces and enhanced usability features. As the population aged 65 and above continues to grow, the market for self-monitoring blood glucose devices is likely to expand, reflecting the changing healthcare landscape.

Increased Health Awareness

Increased health awareness among the population is significantly influencing the Self-Monitoring Blood Glucose Device Market. As individuals become more informed about the implications of diabetes and the importance of regular monitoring, the demand for self-monitoring devices is likely to rise. Educational campaigns and initiatives by health organizations are fostering a culture of proactive health management. This shift towards preventive healthcare is encouraging patients to invest in self-monitoring devices, which are seen as essential tools for maintaining optimal health. Consequently, this trend is expected to contribute to a steady growth trajectory for the market, with projections indicating a potential increase in device adoption rates.

Rising Diabetes Prevalence

The rising prevalence of diabetes worldwide is a critical driver for the Self-Monitoring Blood Glucose Device Market. With the World Health Organization reporting that diabetes cases have nearly quadrupled since 1980, the demand for effective monitoring solutions is escalating. This alarming trend is prompting healthcare providers and patients alike to seek reliable self-monitoring devices. The increasing awareness of diabetes management and the importance of regular glucose monitoring are further propelling market growth. As more individuals are diagnosed with diabetes, the need for self-monitoring devices is expected to rise, potentially leading to a market expansion of over 20 billion USD by 2026.

Technological Advancements

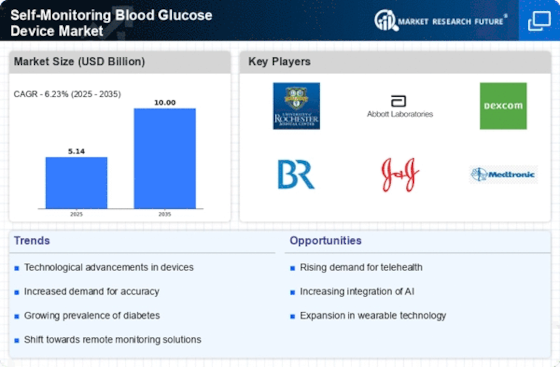

The Self-Monitoring Blood Glucose Device Market is experiencing a surge in technological advancements, which are enhancing the accuracy and usability of these devices. Innovations such as continuous glucose monitoring systems and smartphone integration are becoming increasingly prevalent. These advancements not only improve patient compliance but also provide real-time data, allowing for better management of diabetes. According to recent data, the market for these devices is projected to grow at a compound annual growth rate of approximately 6.5% over the next several years. This growth is largely driven by the increasing demand for user-friendly and efficient monitoring solutions, which are essential for effective diabetes management.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are playing a pivotal role in shaping the Self-Monitoring Blood Glucose Device Market. Governments and health authorities are increasingly recognizing the importance of diabetes management, leading to the establishment of supportive regulations that facilitate market entry for innovative devices. Additionally, many insurance providers are beginning to cover the costs associated with self-monitoring devices, making them more accessible to patients. This financial support is likely to encourage more individuals to utilize these devices, thereby driving market growth. As reimbursement policies continue to evolve, the market is expected to witness a significant uptick in device adoption.

Leave a Comment