Security Labels Market Summary

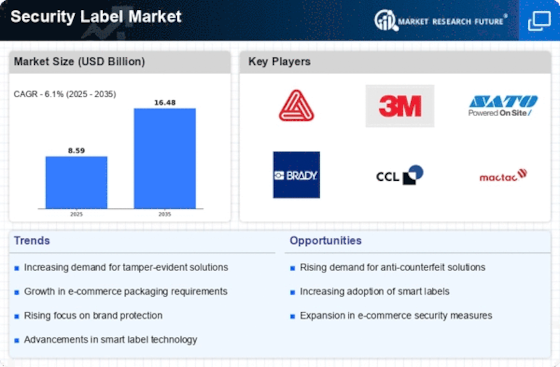

As per Market Research Future analysis, the Security Label Market was estimated at 8.59 USD Billion in 2024. The Security Label industry is projected to grow from 9.114 USD Billion in 2025 to 16.48 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Security Label Market is poised for growth driven by technological advancements and increasing demand for anti-counterfeiting solutions.

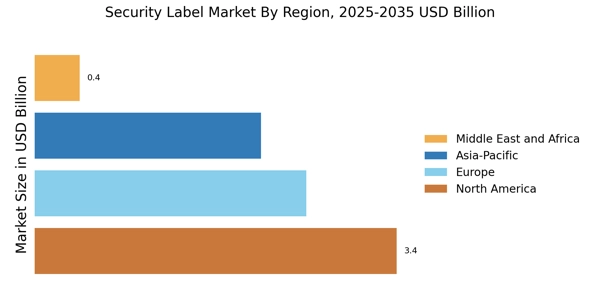

- Technological advancements in labeling solutions are reshaping the Security Label Market, particularly in North America.

- Sustainability in security label production is becoming a focal point, especially in the Asia-Pacific region.

- The barcode segment remains the largest, while the RFID segment is experiencing rapid growth due to evolving consumer preferences.

- Rising demand for anti-counterfeiting solutions and regulatory pressures are key drivers influencing market dynamics.

Market Size & Forecast

| 2024 Market Size | 8.59 (USD Billion) |

| 2035 Market Size | 16.48 (USD Billion) |

| CAGR (2025 - 2035) | 6.1% |

Major Players

Avery Dennison (US), 3M (US), SATO Holdings Corporation (JP), Brady Corporation (US), CCL Industries (CA), Mactac (US), Tesa SE (DE), Uline (US), Zebra Technologies (US)