Top Industry Leaders in the Security Information and Event Management Market

Competitive Landscape of the Security Information and Event Management (SIEM) Market

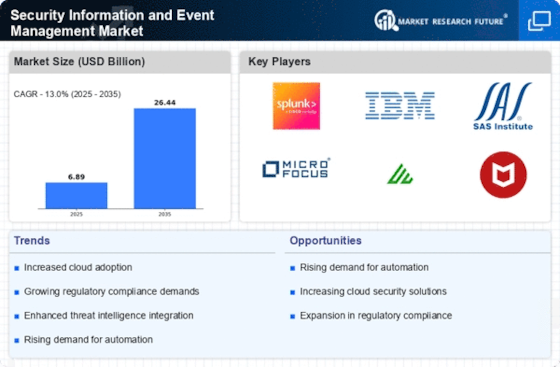

The Security Information and Event Management (SIEM) market is experiencing a surge, propelled by escalating cyber threats and stringent compliance regulations. This dynamic landscape is home to established players vying for dominance alongside nimble newcomers innovating at the edge. Understanding the competitive landscape of the SIEM market requires a close look at key players, their strategies, emerging trends, and factors influencing market share.

Key Players:

- Hewlett Packard Enterprise (US)

- IBM Corporation (US)

- McAfee LLC (US)

- TrendMIcro Inc (Japan)

- Assuria Ltd (UK)

- Dell EMC (US)

- Logrhythm Inc (US)

- LogPoint A/S (Denmark)

- AlienVault Inc (US)

Strategies for Market Dominance:

- Feature Expansion: Vendors are constantly enriching their SIEM platforms with advanced functionalities like threat intelligence integration, machine learning-powered analytics, and automated incident response capabilities. This focus on comprehensive security orchestration and response (SOAR) solutions is key to attracting security-conscious customers.

- Verticalization: Tailoring SIEM solutions to specific industry needs, such as healthcare, finance, or critical infrastructure, is enabling vendors to cater to niche markets and gain a competitive edge. Industry-specific compliance requirements and threat profiles are driving this trend.

- Cloud Adoption: The shift towards cloud-based SIEM solutions is undeniable. Cloud deployments offer faster implementation, scalability, and reduced maintenance costs, making them attractive to organizations of all sizes. Secure cloud infrastructure and data privacy assurances are becoming critical differentiators.

- Partner Ecosystems: Building strong partnerships with technology providers, security consultants, and managed security service providers (MSSPs) is crucial for expanding reach and expertise. Collaboration enables vendors to tap into new markets and offer end-to-end security solutions.

Factors for Market Share Analysis:

- Market Size and Growth Potential: Understanding the overall market size, growth trajectory, and regional variations is essential for identifying lucrative segments and prioritizing investments.

- Product Portfolio and Innovation: Assessing the breadth and depth of a vendor's SIEM solution, its technological advancements, and feature roadmap is crucial for evaluating its competitive edge.

- Customer Base and Industry Focus: Analyzing the vendor's target customer segments, industry expertise, and case studies reveals its market penetration and potential for growth.

- Pricing and Deployment Options: Pricing models, licensing agreements, and deployment options (on-premise, cloud, hybrid) influence vendor appeal to different budget and infrastructure setups.

- Financial Performance and Market Reputation: Tracking a vendor's revenue, profitability, and investment in R&D provides insights into its financial health and commitment to innovation. Industry analyst reports and customer reviews offer valuable perspectives on market reputation and customer satisfaction.

New and Emerging Companies:

Several exciting startups are shaping the future of SIEM with innovative solutions in specific areas:

- Threat Detection and Response: Vectra Networks, Darktrace, and Deepwatch are pioneering advanced threat detection and incident response capabilities within SIEM platforms.

- User and Entity Behavior Analytics (UEBA): Exabeam, Securonix, and Anomali are integrating UEBA technology into SIEM to identify anomalous user behavior and potential insider threats.

- Cloud-Native SIEM: Hunters, Chronicle (acquired by Google), and Cloud SIEM (acquired by Palo Alto Networks) are leading the charge in cloud-based SIEM solutions, specifically designed for cloud environments.

Current Investment Trends:

- AI and Machine Learning: Investors are pouring money into SIEM vendors leveraging AI and machine learning for advanced threat detection, anomaly identification, and automated incident response.

- Security Orchestration and Response (SOAR): Integrated SOAR capabilities within SIEM platforms are attracting significant investment, recognizing the need for automated incident workflows and threat remediation.

- Cloud Security: Cloud-based SIEM offerings are a major investment focus, fueled by the increasing adoption of cloud infrastructure and the need for scalable, cost-effective security solutions.

- Open-Source SIEM: Continued development and advancements in open-source SIEM solutions like ELK Stack are receiving funding due to their growing popularity and customizable nature.

Latest Company Updates:

Sep 20, 2023: Palo Alto Networks acquires Cloud SIEM, boosting cloud security offerings.

Dec 12, 2023: McAfee partners with Rapid7 for integrated SIEM and XDR solution.

Nov 30, 2023: AI and ML gaining traction for threat detection and automated incident response .

Dec 8, 2023: Open-source SIEM solutions like ELK Stack gaining popularity due to cost-effectiveness and customization.

Oct 5, 2023: Cloud-based SIEM becoming the preferred deployment model for scalability and ease of management.