China : Unmatched Market Share and Growth

China holds a dominant 12.5% share of the APAC LED lighting market, valued at approximately $6 billion. Key growth drivers include rapid urbanization, government initiatives promoting energy efficiency, and a shift towards smart lighting solutions. The demand for LED products is bolstered by increasing consumer awareness of energy savings and sustainability. Regulatory policies, such as the Energy Conservation Law, further support this transition, while significant investments in infrastructure and industrial development enhance market potential.

India : Rapid Growth in Urban Areas

India's LED lighting market accounts for 6.5% of the APAC share, valued at around $3 billion. The growth is driven by urbanization, government initiatives like the UJALA scheme, and rising disposable incomes. Demand trends show a shift towards energy-efficient lighting in residential and commercial sectors. The government's push for smart cities and infrastructure development is also a significant factor in market expansion.

Japan : High-Quality Standards and Demand

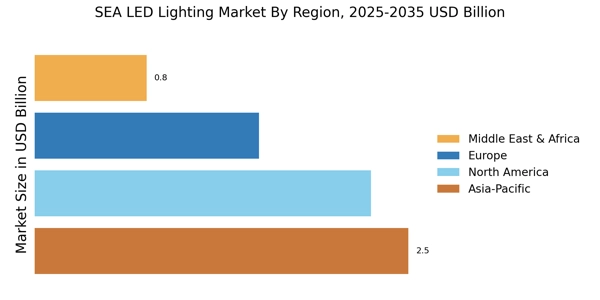

Japan's market share stands at 5.0%, valued at approximately $2.5 billion. The growth is fueled by technological advancements and a strong focus on energy efficiency. Demand for high-quality LED products is prevalent, driven by consumer preferences for durability and performance. Government policies promoting energy conservation and environmental sustainability further enhance market dynamics, while the aging population increases demand for smart lighting solutions.

South Korea : Innovative Solutions and Market Growth

South Korea holds a 3.5% share of the APAC LED market, valued at about $1.7 billion. The growth is propelled by the adoption of smart lighting technologies and government initiatives aimed at reducing energy consumption. Major cities like Seoul and Busan are key markets, with a strong demand for innovative lighting solutions in both residential and commercial sectors. The competitive landscape features significant players like Samsung Electronics and LG Electronics, driving local market dynamics.

Malaysia : Government Support and Market Growth

Malaysia's LED lighting market represents 1.8% of the APAC share, valued at approximately $800 million. Key growth drivers include government support for energy-efficient technologies and increasing awareness of sustainability. Demand trends indicate a shift towards LED solutions in commercial and industrial applications. The government's Green Technology Policy promotes the adoption of energy-efficient lighting, enhancing market potential across urban areas like Kuala Lumpur.

Thailand : Market Expansion in Urban Centers

Thailand's market share is 1.5%, valued at around $700 million. The growth is driven by increasing urbanization and government initiatives promoting energy-efficient lighting. Demand for LED products is rising in both residential and commercial sectors, supported by regulatory frameworks encouraging sustainable practices. Key urban centers like Bangkok are pivotal markets, with a competitive landscape featuring local and international players.

Indonesia : Potential Growth Amidst Barriers

Indonesia's LED lighting market accounts for 0.8% of the APAC share, valued at approximately $400 million. The growth is hindered by infrastructural challenges and limited consumer awareness. However, government initiatives aimed at promoting energy efficiency and sustainability are beginning to take effect. Key markets include Jakarta and Surabaya, where demand for LED solutions is gradually increasing, supported by local players and international brands.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC holds a minimal market share of 0.24%, valued at around $100 million. Growth is uneven, influenced by varying levels of economic development and regulatory frameworks. Demand for LED lighting is emerging in smaller markets, driven by local initiatives and increasing awareness of energy efficiency. The competitive landscape is fragmented, with both local and international players vying for market share in diverse applications.