Top Industry Leaders in the SEA Industrial Robotics Market

Competitive Landscape of the Southeast Asia (SEA) Industrial Robotics Market

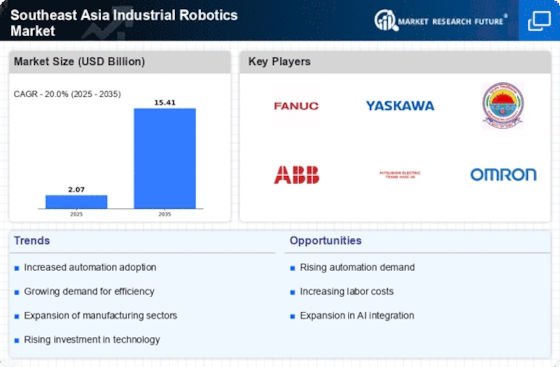

The Southeast Asian (SEA) industrial robotics market is experiencing significant growth, driven by factors like rising labor costs, increasing automation adoption across industries, and government initiatives promoting Industry 4.0. This dynamic market presents a complex competitive landscape with established global players vying for market share alongside regional players and new entrants.

Key Players

- ABB

- Yaskawa Electric Corporation

- FANUC CORPORATION

- KUKAAG

- Mitsubishi Electric

- Kawasaki Heavy Industries

- Denso Corporation

- Nachi- Fujikoshi

- Seiko Epson

- Dürr Group

Adopted Strategies by Key Players:

-

Localization: Global players are establishing regional headquarters and production facilities to cater to local needs, reduce lead times, and offer better after-sales support. This strategy allows them to adapt to local regulations and standards while remaining cost-competitive. -

Strategic Partnerships: Collaboration between robot manufacturers, system integrators, and research institutions is fostering innovation and creating tailored solutions for specific industries. Partnerships enable companies to leverage each other's expertise and expand their reach within the region. -

Focus on SMEs: Recognizing the growing importance of Small and Medium Enterprises (SMEs) in the region's manufacturing sector, some companies are developing cost-effective, user-friendly robot solutions specifically targeted at this segment. This caters to the growing automation needs of SMEs without significant upfront investment. -

Digitalization: Leading companies are integrating digital technologies like cloud computing, artificial intelligence, and the Internet of Things (IoT) with their robots. This allows for remote monitoring, predictive maintenance, and data-driven insights to optimize robot performance and productivity.

Factors for Market Share Analysis:

-

Product Portfolio: The breadth and depth of a company's robot offerings, including payload capacity, reach, and functionalities, cater to diverse industry requirements. A well-diversified portfolio strengthens a company's position across various application segments. -

Brand Recognition: Established global brands with a strong reputation for quality and reliability hold a significant advantage. Local players with a well-established presence and brand recognition within the SEA region can also compete effectively. -

Distribution Network: A robust network of distributors and resellers ensures efficient product reach and customer support across the region. This is particularly important for timely after-sales service and technical assistance. -

Service and Support: The quality and accessibility of after-sales service, including maintenance, repair, and training programs, significantly impact customer satisfaction and brand loyalty. Companies with efficient service networks gain a competitive edge.

New and Emerging Companies:

-

Techtronic Industries (TTI): This Hong Kong-based company has a strong presence in the SEA region and offers a comprehensive range of industrial robots under the "TTI" brand. -

Hiwin: A Taiwanese company known for its affordable and user-friendly robots, Hiwin is gaining traction among SMEs in the region. -

Anbas: This Singapore-based company specializes in collaborative robots (cobots) designed for safe human-robot interaction, catering to the growing demand for human-centric automation solutions.

Latest Company Updates

ABB:

- March 2023: ABB reaffirmed its commitment to the US market by expanding its robotics headquarters and production plant in Auburn Hills, Michigan. This news indirectly indicates ABB's continued investment in robotics production, which could benefit their SEA operations as well.

Yaskawa Electric Corporation:

- February 2022: Yaskawa Motoman introduced two new six-axis collaborative robots, the HC10DTP and HC20DTP [Source: The Insight Partners, Industrial Robotics Market Growth Report & Forecast - 2030].