Rise of Cybersecurity Threats

As educational institutions increasingly rely on digital platforms, the rise of cybersecurity threats is becoming a pressing concern within the Global School and Campus Security market Industry. Cyberattacks targeting school networks can compromise sensitive student information and disrupt educational operations. In response, schools are prioritizing cybersecurity measures, including firewalls, encryption, and staff training on cyber awareness. This shift towards safeguarding digital assets is expected to contribute to the overall growth of the security market, as institutions seek to protect both physical and virtual environments from emerging threats.

Increasing Incidents of School Violence

The rise in incidents of school violence globally has heightened the demand for robust security measures within educational institutions. This trend is particularly evident in regions experiencing socio-political unrest, where schools have become vulnerable targets. The Global School and Campus Security market Industry is responding to these challenges by implementing advanced surveillance systems, access control technologies, and emergency response protocols. As a result, the market is projected to reach 3 USD Billion in 2024, reflecting a growing recognition of the need for enhanced safety measures in schools. This focus on security is likely to continue driving investments in innovative solutions.

Growing Awareness of Mental Health Issues

The increasing awareness of mental health issues among students is influencing the Global School and Campus Security market Industry. Schools are recognizing the importance of addressing mental health as a component of overall safety. This awareness has led to the integration of mental health resources and support systems within security frameworks. By fostering a supportive environment, schools aim to mitigate potential threats stemming from mental health crises. Consequently, this trend is likely to drive investments in comprehensive security solutions that encompass both physical safety and mental well-being, further expanding the market.

Government Regulations and Funding Initiatives

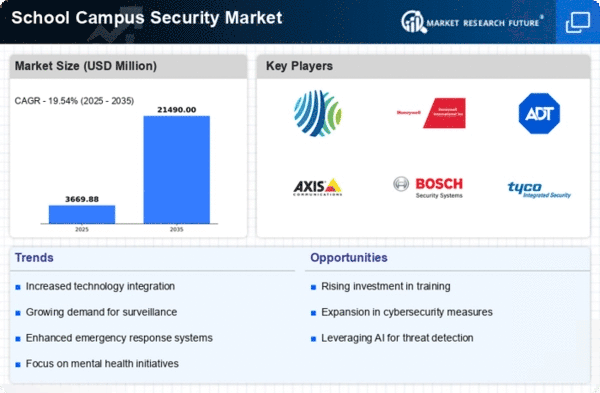

Government regulations aimed at improving school safety are playing a crucial role in shaping the Global School and Campus Security market Industry. Many governments are introducing policies that mandate the implementation of security measures in educational institutions. Additionally, funding initiatives are being established to support schools in acquiring necessary security technologies. This regulatory environment encourages schools to invest in security infrastructure, thereby propelling market growth. As a result, the market is anticipated to experience a compound annual growth rate of 19.62% from 2025 to 2035, driven by increased government support for security enhancements in schools.

Technological Advancements in Security Solutions

Technological innovations are transforming the landscape of the Global School and Campus Security market Industry. The integration of artificial intelligence, machine learning, and IoT devices into security systems enhances threat detection and response capabilities. For instance, smart surveillance cameras equipped with facial recognition technology can identify potential threats in real-time. This shift towards technology-driven solutions is expected to contribute significantly to market growth, with projections indicating an increase to 21.5 USD Billion by 2035. Educational institutions are increasingly adopting these advanced technologies to create safer environments for students and staff, thereby driving the demand for sophisticated security solutions.